Wheel prices are climbing, and tariff policies are the driving force behind these increases. The numbers tell the story clearly: wheel prices have jumped 0.2% across both imported and domestic products. This affects every wheel buyer, from performance enthusiasts upgrading their rides to everyday drivers replacing damaged rims.

The 2025 tariff plan brings sweeping changes to the market. Chinese imports now face 10% tariffs, while Mexican and Canadian imports carry a hefty 25% rate. These aren't just numbers on paper – they directly impact your wallet when you're shopping for wheels.

The ripple effects extend throughout the automotive aftermarket. Imported tires from Canada, Mexico, Thailand, and India all face a standard 25% tariff. Chinese tires get hit even harder with an effective 150% tariff rate (25% plus a 125% reciprocal tariff). The result? Higher prices at every level of the supply chain.

Here's what these policies mean in real terms: the government projects $140 billion in tariff revenue for 2025 and $1.5 trillion by 2035. But that revenue comes directly from businesses and consumers paying more for the same products. Industry analysts warn these measures could cost US carmakers $108 billion and slash vehicle production by 17.7 million units.

Understanding how tariffs reshape wheel pricing helps you make smarter purchasing decisions. We'll break down exactly how these policies affect both raw materials and finished products, show you where the hidden costs appear, and provide practical strategies to minimize their impact on your wheel and tire budget.

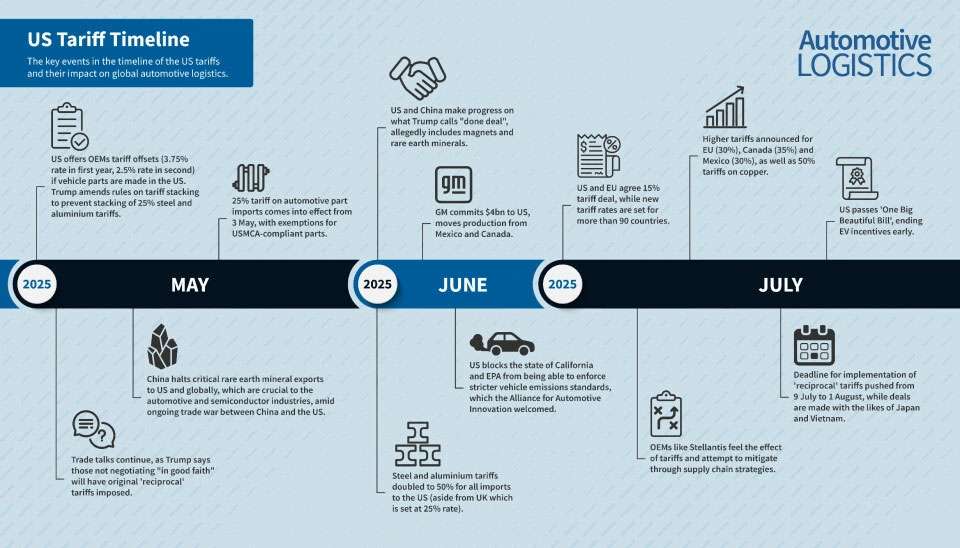

Image Source: Automotive Logistics

Tariffs operate as government-imposed taxes that fundamentally change how the wheel industry does business. These duties serve multiple purposes: generating revenue for the government, protecting domestic manufacturers from foreign competition, and applying economic pressure during trade negotiations. The wheel industry feels these effects acutely because tariffs hit both raw materials like steel and aluminum, and finished wheel products.

A tariff functions as a tax on imported goods that importers must pay when products cross the border. This cost gets passed along the supply chain, ultimately reaching consumers through higher retail prices. Since February 2025, U.S. trade policy has undergone massive changes with new tariffs covering automobiles, auto parts, steel, aluminum, and various imported products. The goal is reducing trade deficits while rebuilding domestic manufacturing capacity.

Wheel buyers feel tariff impacts in several ways:

Higher retail prices for both imported and domestic wheels

Reduced competitiveness of foreign-made products

Altered purchasing patterns as consumers seek alternatives

Decreased export opportunities for countries facing these duties

The U.S. has implemented multiple wheel-related tariffs over recent years, especially targeting steel and aluminum wheels during trade disputes with major exporters like China.

The Harmonized Tariff Schedule (HTS) codes determine exactly which products face tariffs and at what rates. Think of these codes as the government's filing system for imported goods. For wheels, several key classifications matter:

Chapter 76 - Raw aluminum articles directly impacted by tariffs

Chapter 87 - Vehicle parts including finished wheels

Chapter 73 - Steel products including wheel components

U.S. Customs and Border Protection applies different duty rates based on specific HTS codes:

9903.81.87: Iron or steel products (excluding derivatives) - 25% duty

9903.85.02: Aluminum products excluding derivatives

9903.85.04: Derivative aluminum products subject to Section 232

The classification determines whether a product faces the full 25% tariff on steel or aluminum. Finished wheels typically fall under Chapter 87 and might avoid raw material tariffs, though "derivative products" can be added to tariff lists later.

Tariffs increase imported wheel costs through multiple channels. Complete wheels manufactured overseas face the full applicable duty rate when they enter the U.S. market. Manufacturers must either absorb the costs or pass them to consumers. Aftermarket wheels using imported materials face particular pricing pressure, making affordable options harder to find.

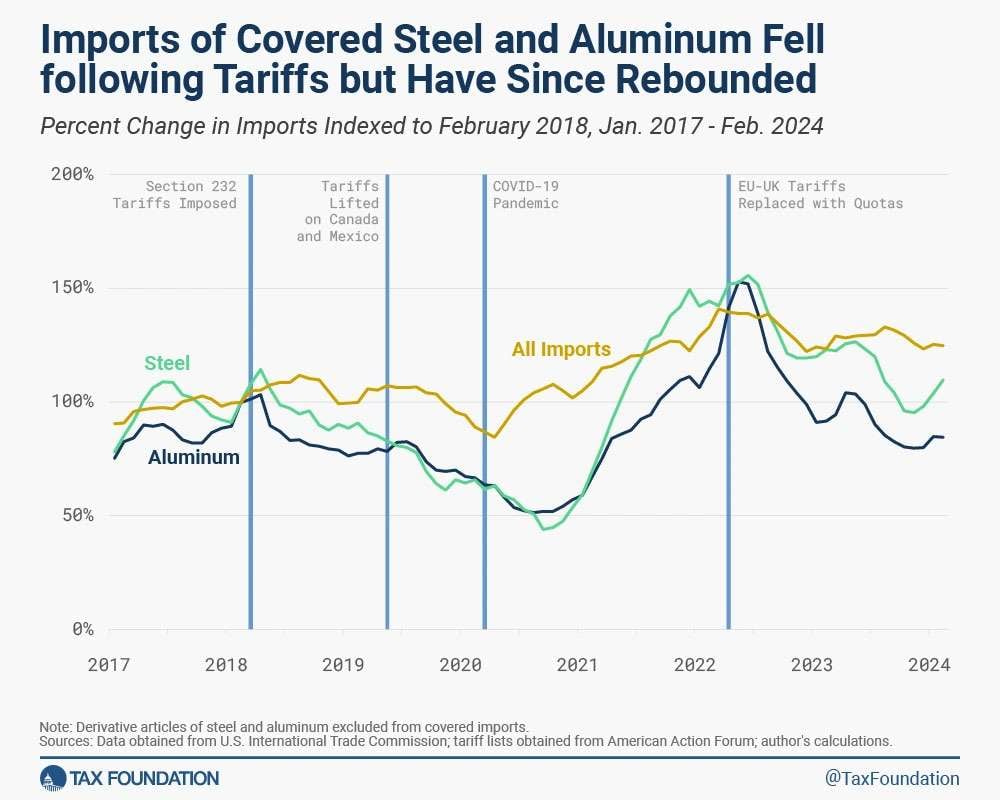

Image Source: Tax Foundation

Section 232 tariffs operate under the Trade Expansion Act of 1962, giving the President authority to impose duties on imports that threaten national security. Steel faced 25% tariffs while aluminum got 10% rates when implemented in March 2018. Policy changes drove these rates higher - 50% for most countries as of June 2025, though the United Kingdom maintains a 25% rate.

The results were immediate and substantial. Steel imports dropped 24% while aluminum imports fell 31%. This supply squeeze created pressure on domestic material availability for wheel manufacturers. The tariffs don't stop at raw materials - they also target "derivative products," which means items manufactured using steel or aluminum as inputs.

The U.S. International Trade Commission documented direct price impacts: steel prices rose 2.4% and aluminum climbed 1.6% between 2018-2021. U.S. importers absorbed nearly the full tariff cost, with import prices tracking tariff rates almost exactly.

Some manufacturers faced even steeper increases. Jordan Manufacturing doesn't import steel directly but buys from domestic suppliers. They reported steel coil price jumps of 5-10%. Reduced foreign competition allowed domestic suppliers to push prices higher across the board.

These increases boosted domestic metal production significantly. U.S. manufacturers also deal with supply chain disruptions, contract renegotiation pressures, and production scheduling complications. Without adequate time to adapt to new tariff structures, many wheel producers pass these costs straight to consumers.

Bill Hanvey, Auto Care Association president, puts it bluntly: tariffs have a "serious impact" on both the automotive aftermarket and consumers. Here's the reality – these duties don't get paid by foreign countries. Businesses and consumers in the domestic market absorb every penny.

For aftermarket wheel segment enthusiasts, this creates a double hit. Many specialty wheels contain imported materials now subject to duties, making reasonably priced options increasingly difficult to find. You're not just paying more – you're getting fewer choices.

The U.S. International Trade Commission documented a 0.2% wheel price increase across the entire industry following tariff implementation. That might sound small, but it affects every wheel purchase, whether you're buying imported or domestic products.

Domestic manufacturers face higher production costs due to expensive raw materials. They pass these costs directly to consumers. Even wheels made in America cost more because the steel and aluminum inputs carry tariff-inflated prices.

Tariffs create market-wide price floors that hurt all consumers. The wheel industry sits right in the middle of these economic disruptions, feeling the impact from both sides of the equation.

Section 232 tariffs protected some steel jobs while destroying far more positions in industries that depend on affordable steel and aluminum. The math is stark: approximately 75,000 workers lost their jobs in downstream manufacturing sectors.

The hardest-hit industries include:

Auto parts manufacturing

Construction

Industrial machinery production

Household appliance manufacturing

For wheel manufacturers, this employment shift means higher labor costs in some areas and reduced capacity in others. When suppliers lose workers or shut down operations, it disrupts the entire supply chain.

Every steel job preserved came with an extraordinary price tag. The Peterson Institute for International Economics calculated that each position saved cost the broader economy approximately $650,000. Steel industry profits jumped by $2.4 billion in 2018, but steel-using industries absorbed $5.6 billion in additional costs.

This imbalance hits wheel manufacturers particularly hard. They pay higher prices for raw materials while competing against imports that may still undercut domestic production costs. The result? Squeezed profit margins and pressure to raise prices.

Tariffs trigger retaliation from trading partners, creating additional economic pressures. After the 2018 steel and aluminum tariffs, the European Union imposed countermeasures on $2.8 billion worth of American goods. These trade disputes reduce export opportunities for domestic manufacturers and create uncertainty in global supply chains.

Wheel manufacturers face the double impact of higher input costs and reduced export markets. Many companies that built their business models around affordable imported materials now struggle with fundamentally changed economics. The ripple effects continue to reshape how the industry sources materials and prices products.

Selecting wheels manufactured in the United States helps you sidestep the extra costs associated with imported products. Wheels and other aftermarket parts made in Taiwan or the U.S. are currently classified as finished goods and exempt from these tariffs. However, these advantages could disappear if the government reclassifies wheels as derivative aluminum products, potentially subjecting them to a 25% tariff.

When shopping for domestic wheels, look for brands that clearly specify their manufacturing location. Many quality American manufacturers offer competitive pricing that becomes even more attractive when you factor in tariff savings.

High-quality aftermarket wheel brands often cost less than branded imports. We've seen manufacturers adapt quickly to these market changes by offering alternatives like:

High-performance polymers and hybrid designs unaffected by steel tariffs

Components sourced from countries with favorable trade rates

Products that reduce total ownership costs through longer lifespan and better performance

The key is researching which brands source their materials domestically or from countries with lower tariff rates. This homework pays off when you find wheels that deliver the style and performance you want without the tariff penalty.

Policy changes create buying opportunities for informed consumers. Staying current on tariff developments allows for strategic timing of wheel purchases. When products face potential future tariff increases, buying sooner rather than later makes financial sense.

Research brands' supply chains and manufacturing locations before making your purchase decision. Understanding where your wheels come from helps you predict future pricing and make smarter timing choices. Our expert team stays current on these developments and can guide you through the best options for your specific needs and budget.

Tariff policies have created a new reality for wheel buyers, and understanding these changes helps you make better purchasing decisions. The 0.2% price increase across both domestic and imported wheels represents just the beginning of these market shifts. When you factor in raw material cost increases—steel up 2.4% and aluminum up 1.6%—the total impact on your wheel budget becomes substantial.

The numbers reveal the true cost of these policies. Each job saved in the steel sector costs $650,000, while 75,000 jobs disappeared from industries that depend on affordable materials. These trade-offs directly affect the wheel market, where manufacturers face difficult choices between absorbing costs or passing them to customers.

Smart wheel buyers have strategies to minimize these impacts. Choosing U.S.-made wheels avoids import duties entirely. Exploring aftermarket alternatives with lower tariff exposure can save significant money. Timing your purchases around policy changes makes financial sense when facing potential price increases.

The wheel industry shows how trade policies create winners and losers throughout the supply chain. Government projections of $140 billion in 2025 tariff revenue and $1.5 trillion by 2035 come directly from businesses and consumers paying more for the same products. These aren't abstract policy discussions—they affect real people buying wheels for their vehicles.

At Performance Plus Tire, we help customers find the best wheel values despite these market pressures. Our huge selection includes domestic options that avoid tariffs and imported wheels at competitive prices. We monitor policy changes to provide current information about which products offer the best deals.

The automotive aftermarket continues to evolve with these policy changes. Wheels represent one component in a supply chain facing increased costs and complexity. Our expert team stays current with these developments to help you find wheels that deliver both style and value, regardless of trade policy fluctuations.

Understanding how tariffs reshape wheel pricing helps consumers and businesses navigate today's complex automotive supply chain economics.

• Tariffs drive wheel prices up 0.2% across all brands - Both imported and domestic wheels cost more due to higher raw material expenses and reduced foreign competition.

• Raw material costs surge significantly - Steel prices increased 2.4% and aluminum 1.6% from Section 232 tariffs, forcing manufacturers to pass costs to consumers.

• Economic trade-offs are substantial - Each steel job saved costs $650,000 while 75,000 jobs were lost in tariff-affected industries, creating market imbalances.

• Smart purchasing strategies can offset costs - Choose U.S.-made wheels, explore tariff-exempt aftermarket alternatives, and time purchases around policy changes.

• Supply chain disruptions extend beyond pricing - New 2025 tariffs of 10% on Chinese imports and 25% on Mexican/Canadian goods will reshape automotive sourcing strategies.

The wheel industry exemplifies how trade policies create winners and losers throughout the economy. While tariffs aim to protect domestic manufacturing, they simultaneously increase costs for consumers and downstream industries, making strategic purchasing decisions more critical than ever.

Tariffs have led to a 0.2% increase in wheel prices across both imported and domestic brands. This seemingly small percentage can significantly affect consumers in the cost-sensitive automotive market, especially when combined with other market pressures.

While tariffs aim to protect domestic industries, they create significant trade-offs. For instance, each job saved in the steel sector costs approximately $650,000, while an estimated 75,000 jobs have been lost in tariff-affected industries overall.

Section 232 tariffs have increased steel prices by 2.4% and aluminum prices by 1.6%. These increases in raw material costs have forced manufacturers to either absorb the costs or pass them on to consumers.

Consumers can mitigate tariff-related costs by choosing U.S.-made wheels, exploring aftermarket alternatives with lower tariff exposure, and strategically timing their purchases based on policy changes.