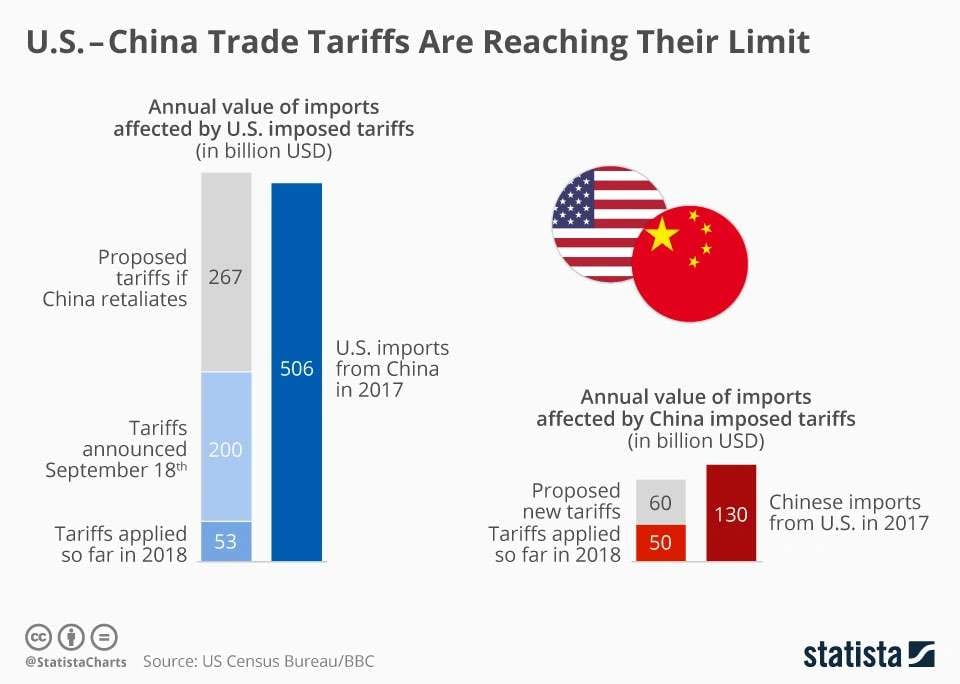

Tire prices across America are climbing as new tariff policies create serious market challenges. A record 63.4% of tires sold in the U.S. last year were imported, making recent tariff changes particularly important for consumers and businesses. These tariffs now range from 26% to 46% on imports from several key countries, creating significant changes in the tire supply market.

The situation has become more complicated in 2025. Overall global imports of truck and bus radial (TBR) tires into the U.S. dropped by 7.9% compared to 2024. The federal government enacted major increases on these tariffs during May and June 2025. Steel tariffs have jumped from 25% to 95% for most steel products. Importing tires into the US has become more challenging and expensive. Analysts predict substantial price increases due to these tariffs, which target major exporting countries including Thailand, Indonesia, Vietnam, and South Korea. For consumers, this means higher costs - parts that once cost $50 might soon cost $60 or more if these tariff policies continue.

Tariffs aren't the only factor driving tire prices higher. Rising labor costs, fluctuating raw material prices (particularly rubber, steel, and petroleum-based products), and increased transportation expenses all add pressure on tire manufacturers and distributors. The tire industry faces uncertainty and market volatility as these forces reshape the market.

Image Source: Statista

The tire industry faces major changes as new trade policies take effect. Domestic manufacturers and importers are working to adapt to these shifting conditions.

April 2025 brought a sweeping 25% tariff on imported auto parts, including passenger and light truck tires, into effect. This Section 232 tariff was implemented as a national security measure, with the White House noting that articles may also be subject to additional antidumping or countervailing duties. A base tariff of 10% was applied to most commercial truck tires and other tire types, while the full 25% was imposed on passenger and light vehicle tires. The only exception applies to parts meeting U.S.-Mexico-Canada Agreement requirements.

China tires tariff history goes back to 2009 when the Obama administration first introduced a 35% tariff rate to boost domestic production. Since then, Chinese imports have dropped dramatically. After peaking at 9.22 million truck and bus tires in 2018, Chinese imports fell to just 1.76 million by 2022. Currently, tires from China face an effective tariff of 150% (25% base plus 125% reciprocal tariff). This steep decline prompted manufacturers to relocate production to other Asian countries like Thailand, Vietnam, and Cambodia.

The administration imposed country-specific reciprocal tariffs on major exporters:

Thailand: 37% (the largest exporter at 35.3 million passenger tires)

Indonesia: 32%

Vietnam: 46%

South Korea: 26%

These tariffs have triggered price increases across the industry. Yokohama announced a 10% increase on commercial truck tires effective May 1, while Sumitomo plans similar 10% increases. Goodyear hasn't raised truck tire prices yet, but all manufacturers face rising raw material costs since the U.S. must import all its natural rubber needs. Both imported and domestic products will likely see continued price increases as the market adjusts to this new reality.

Beyond tariffs, the tire industry faces serious supply chain challenges that add to pricing pressures and availability issues. These disruptions create multiple problems for importers and consumers.

Tire imports involve strict regulatory oversight from both the National Highway Traffic Safety Administration and Department of Transportation. Importers must secure customs bonds and meet complex antidumping duties that apply to South Korea, Taiwan, Thailand, and Vietnam. These AD/CVD orders can add up to an additional 500% of the value stated on commercial invoices.

Many businesses have changed their inventory strategies due to market uncertainty. After availability struggles during the pandemic, tire inventories have stabilized. New tire levels decreased slightly by 0.3% in 2023 while retread inventory rose by 0.4%. The North American replacement market shows growth driven by buyers purchasing ahead of additional customs duties.

Logistical challenges have gotten worse. Freight rates have jumped up to 500%. Transit times from India to the East Coast have stretched from 28 to 43 days. Vessels rerouted through the Cape of Good Hope face delays of 15-28 days. These longer lead times force distributors to order product 45 days earlier than normal projections.

Southeast Asian countries have stepped in as Chinese imports drop:

Cambodia's passenger tire exports jumped 56% in early 2025, moving it from eighth to fourth-largest supplier

Cambodia's light truck tire exports surged 75% year-over-year

Vietnam remains the third-largest supplier to the US with 10.9 million units

This shift shows manufacturers moving production to avoid tariffs rather than reduced market demand.

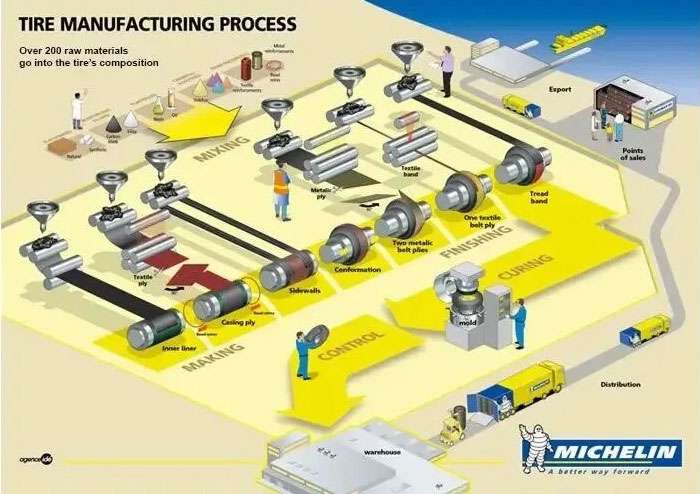

Image Source: Michelin Tires

Tire production costs involve much more than tariff concerns. Several key factors create ongoing price pressures that affect the entire industry.

Natural rubber, which constitutes approximately 35% of raw material costs for tire companies, has surged dramatically—increasing 72% over two quarters and 33% year-on-year in early 2023. Raw materials now account for 60% of total production expenses. Natural and synthetic rubber plus carbon black together make up roughly half a car tire's composition. Carbon black alone doubled in price over a two-year period. Crude oil fluctuations directly impact synthetic rubber costs, adding another layer of price volatility.

Workforce expenses have risen sharply across manufacturing facilities. Service centers have increased labor rates from $40 to $50 per hour. Individual technicians have seen wages jump from $10 to $16.50 hourly within a single year. Energy consumption during vulcanization and curing processes adds 15-20% to manufacturing costs. These increases affect both production facilities and service centers.

Regulatory requirements continue tightening across the industry. EPA proposals could cost the tire industry $20.8 million annually. EU regulations will mandate 35% recycled content by 2028, forcing substantial investments in sustainable production methods. These compliance costs ultimately get passed to consumers.

Manufacturers are investing in costly technological advancements. These range from NASA-derived shape memory alloy radial technology to silica-based compounds that enhance energy efficiency. These innovations improve tire performance but drive up production costs. The industry continues pushing forward with smart tire technology and advanced materials that benefit consumers but require significant investment.

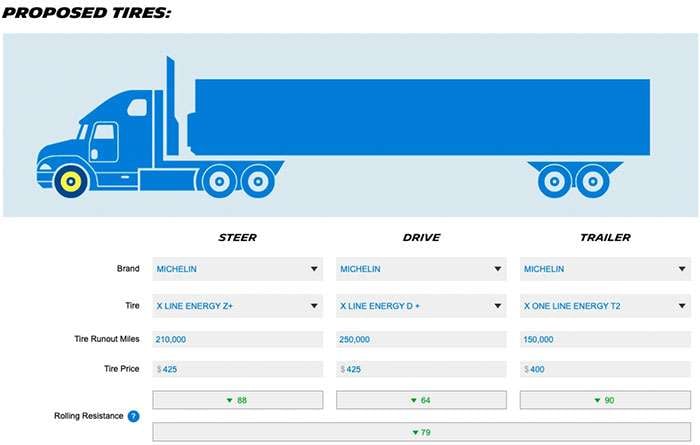

Image Source: MICHELIN COMMERCIAL TIRES - Michelin Tires

Facing higher prices, tire buyers and fleet managers are finding smart ways to keep operations running while controlling costs.

Smart buyers are making strategic choices. After eight consecutive months of tier-three tires leading sales, tier-two brands took the top spot in January 2025. This shift shows consumers balancing quality with price during winter challenges.

The retreading market offers excellent savings opportunities. Retreaded tires cost just a fraction of new ones. Nearly 90% of fleets with 100+ trucks use retreads, which can extend tire life up to 500% longer than single-use options. That's real value for your dollar.

Regional hauling has become a major market segment. The regional haul segment now makes up about 40% of the North American trucking market, driven by e-commerce growth. These vehicles typically operate within a 300-mile radius, returning to base nightly.

Regional application tires need extra sidewall reinforcement, high-scrub tread compounds, and denser rubber to handle curbing and street conditions. Choosing the right tire for your application makes a significant difference in performance and longevity.

For fleets, tires represent about 5% of total cost of ownership (TCO), but their impact goes beyond the purchase price. Premium, retreadable tires often deliver better long-term value through improved performance, longer life, and better fuel economy.

Fleets calculate tire-related TCO using this formula: "Tire Cost Per Mile + Resulting Fuel Consumption". This approach helps identify the best value options for your specific operation.

Savvy consumers are taking action to combat rising prices. Successful strategies include thorough brand comparison, monitoring sales promotions, seeking rebates, and checking warranties.

Negotiating works. 63% of those who negotiated secured better deals, saving an average of $37 per tire. Don't be afraid to ask for a better price.

For professional advice on selecting cost-effective tires for your specific needs, visit Performance Plus Tire. Our experts can help you find the best tire options that deliver both performance and value for your vehicle and driving requirements.

The tire industry faces major changes right now. Tariffs have shifted the market landscape, with Thailand, Vietnam, and Cambodia becoming major suppliers while Chinese imports continue dropping sharply. These policy changes, along with supply chain disruptions, have created significant price increases across all tire segments.

Raw material costs present another serious challenge. Natural rubber prices have jumped 72% over just two quarters, while carbon black costs have doubled in recent years. Rising labor expenses and environmental regulations add even more pressure to manufacturing costs.

Consumers and fleet managers are finding smart ways to handle these challenges. Many have moved toward value-tier options and retreadable tires, which can extend useful life up to 500% compared to single-use alternatives. Others focus on calculating the true total cost of ownership rather than just purchase price. Smart buyers use tactics like comparison shopping and price negotiation - with 63% of negotiators getting better deals.

Whatever approach you choose, staying informed about market trends is essential for making cost-effective tire purchases. Consulting with tire experts at Performance Plus Tire can help you identify the best options for your specific vehicle and driving needs. While tire prices will likely stay elevated due to these global factors, strategic purchasing decisions can still minimize the impact on your budget while ensuring safety and performance on the road.

Understanding how tariffs and supply chain disruptions are driving tire prices higher can help consumers and businesses make smarter purchasing decisions in this volatile market.

• Tariffs are dramatically reshaping tire costs: New tariffs range from 26% to 150% on imports from major suppliers, with Thailand facing 37% and China hit with 150% effective rates.

• Supply chain disruptions compound price pressures: Freight costs have surged up to 500% while shipping delays extend 15-28 days, forcing distributors to order 45 days earlier than normal.

• Raw material volatility drives manufacturing costs: Natural rubber prices jumped 72% in two quarters, while carbon black doubled over two years, with raw materials now comprising 60% of production expenses.

• Strategic purchasing can offset rising prices: Consumers who negotiate save an average of $37 per tire, while fleets increasingly choose retreadable tires that extend life up to 500% longer than single-use options.

• Focus on total cost of ownership, not just purchase price: Premium retreadable tires often deliver lower long-term expenses through better fuel efficiency, performance, and longevity despite higher upfront costs.

The tire market's transformation reflects broader global trade tensions, but informed buyers can still find value through strategic purchasing, brand comparison, and focusing on long-term performance rather than just initial price points.

Tariffs have significantly increased tire prices in the US. Recent tariffs range from 26% to 150% on imports from major suppliers, with Thailand facing a 37% tariff and China hit with a 150% effective rate. These tariffs have led to price increases across the industry, with some manufacturers announcing 10% increases on commercial truck tires.

Besides tariffs, several factors are driving up tire costs. These include raw material price volatility (especially rubber, steel, and oil), increased labor and manufacturing costs, stricter environmental regulations, and investments in new tire technologies. For instance, natural rubber prices have surged 72% over two quarters, while carbon black costs have doubled in recent years.

Supply chain disruptions are causing significant challenges in the tire industry. Freight costs have increased by up to 500%, while shipping delays have extended by 15-28 days. These issues are forcing distributors to order products 45 days earlier than usual, leading to inventory stockpiling and increased costs throughout the supply chain.

Consumers can employ several strategies to manage rising tire prices. These include thorough brand comparison, monitoring sales promotions, seeking rebates, and scrutinizing warranties. Negotiating can also yield significant savings, with 63% of those who negotiated securing better deals, averaging $37 per tire. Additionally, considering the total cost of ownership rather than just the purchase price can lead to more cost-effective decisions in the long run.

Fleet managers are adapting to increased tire costs by focusing on the total cost of ownership rather than just initial purchase prices. Many are shifting towards value-tier and retreadable tires, which can extend tire life up to 500% longer than single-use options. Nearly 90% of fleets with 100+ trucks now utilize retreads. Fleet managers are also calculating tire-related costs using formulas that consider both tire cost per mile and resulting fuel consumption to make more informed purchasing decisions.