Tire financing provides the perfect solution when you need quality tires but want to manage your cash flow effectively. Multiple payment options make tire purchases accessible regardless of your current budget situation or credit profile.

We offer flexible tire payment plans through trusted partners like PayPair, including buy now pay later options, rent-to-own programs, and no money down solutions that work for virtually every customer. Most applications receive instant approval decisions without impacting your credit bureau score. You can secure financing in seconds while selecting your ideal tire and wheel combination.

Monthly payment arrangements on tires and wheels come with straightforward, customer-friendly terms. Options range from 6-month financing on purchases over $149 to early buyout opportunities within 90 days, ensuring there's a payment plan that fits your specific budget requirements. Tire retailers now provide specialized programs for customers with limited or challenged credit history, making quality tires available to everyone who needs them.

Tire financing breaks down the cost of new tires into manageable payments spread over time, eliminating the need for large upfront expenses. This payment approach has gained tremendous value as complete tire sets with installation now cost between $800-$1000.

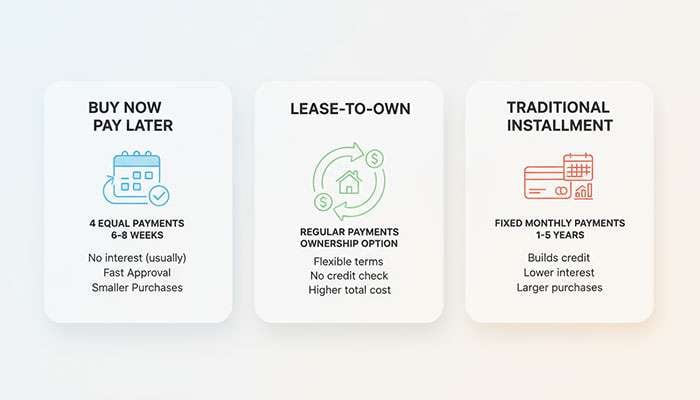

Tire financing bridges the gap between your immediate tire needs and current budget situation. Two main categories serve different customer needs: traditional financing and lease-to-own arrangements. Traditional financing works like other installment loans, providing approved credit amounts based on your credit profile with fixed monthly payments. Interest rates span from 0% to 36% APR depending on your creditworthiness.

Lease-to-own models offer a different approach. You get the tires immediately while making regular payments toward eventual ownership. Payment schedules align with your pay periods—weekly, biweekly, or monthly—for better cash flow management. Most programs include early buyout options within 90-101 days, potentially saving money versus completing the full payment term.

Key terminology you should understand:

Lease-to-Own/Rent-to-Own: Financing companies buy tires from retailers and maintain ownership until you complete payments

Installment Plans: Structured loan arrangements featuring equal payments over set periods

APR (Annual Percentage Rate): Total yearly borrowing costs including interest and fees

Early Buyout Option (EBO): Purchase opportunity during specific periods at reduced total costs

Safety concerns drive many financing decisions. Recent data reveals 646 people died in tire-related crashes during 2023. An NHTSA study found nearly half of 11,500 examined vehicles had at least one tire with half-worn tread, while 10% had completely bald tires.

Tire financing becomes essential when:

Safety requires immediate replacement but funds aren't available

You prefer steady cash flow over large one-time expenses

Premium tires exceed your current budget but offer needed performance

Truck owners face upcoming price increases up to 10% starting May 2025

Performance facts matter: half-tread tires hydroplane at just 40 mph on wet roads—3-4 mph slower than new tires. Your braking distance increases by 3-6 feet from 40 mph on wet pavement. These safety concerns make financing a smart choice rather than driving on unsafe tires.

At Performance Plus Tire, we understand that safety can't wait for your next paycheck. Performance Plus Tire's financing programs provide solutions for various credit situations, ensuring you get quality tires when you need them.

Several myths prevent people from considering tire financing options. Many believe perfect credit is required for approval. Actually, numerous programs evaluate beyond traditional credit scores, considering income stability and banking history when making approval decisions.

Another common misconception assumes all financing carries extremely high interest rates. While some poor-credit lenders charge significant rates, many retailers offer promotional 0% interest periods or reasonable terms for qualified buyers. Most no-credit-needed financing options use soft credit checks that won't impact your credit score.

Understanding the difference between "no credit check" and "no credit needed" helps clarify options. No credit check means your credit won't be pulled during the process, while no credit needed indicates your credit score might be checked but represents just one approval factor.

Financing doesn't automatically mean paying more. Early buyout options offered by most lease-to-own programs can save money when you pay off your balance within the specified timeframe, typically the first 90 days.

Tire financing approval happens in minutes, not days, unlike traditional bank loans. The process is remarkably straightforward, and understanding each step helps you secure the best terms for your specific situation.

Start by selecting the tires you need. Most retailers let you browse online and build your cart before applying for financing. After choosing your products, select a financing option at checkout. Here's exactly what happens next:

Complete a simple application - Provide basic personal information including name, address, phone number, email, Social Security Number, date of birth, and income details.

Review financing options - Compare available providers based on:

Initial payment requirements (typically $0.00-$59.00)

Maximum approval amounts (up to $6500.00)

Interest rates (including 0% options)

Repayment terms (ranging from 3-36 months)

Get an instant decision - Most applications return results within seconds.

Finalize your purchase - Review terms carefully, especially payment schedules and early buyout options, then complete checkout.

Credit check terminology can be confusing when applying for tire financing. "No credit check" and "no credit needed" represent completely different approaches.

"No credit check" means your credit report won't be pulled during the application process. "No credit needed" indicates your credit score might be checked but represents just one of several approval factors. Lenders using alternative evaluation methods might advertise no credit checks but still evaluate creditworthiness through different criteria.

For installment plans like Affirm, a soft credit inquiry confirms your ability to repay without affecting your credit score. With lease-to-own options like Snap, Progressive, or Acima, the approval process evaluates non-traditional factors beyond credit scores.

The approval process delivers results quickly. With providers like Affirm, you'll know within minutes:

The amount you've been approved for

Available repayment timeframes

Specific payment plan options

Most lease-to-own providers offer instant decisions through proprietary algorithms that consider factors beyond traditional credit. To qualify for most financing options, you'll need to be:

18+ years old with valid contact information

Have a steady income source

Maintain an active checking account (for lease-to-own)

Provide government-issued photo ID

Pre-qualification typically won't impact your credit score, though accepting certain offers may involve additional reporting. After approval, you'll need to add a payment method—either a debit card or set up autopay—before receiving final confirmation.

Early purchase options exist between 90-101 days with most providers, potentially reducing your total cost significantly[91].

Tire retailers understand that different customers have different financial situations and credit profiles. We work with multiple financing partners to offer payment solutions that match your specific needs and budget requirements.

Short-term payment arrangements divide your tire purchase into manageable installments without long-term commitments. Affirm structures payments over 3, 6, or 12 months with APRs from 0-36% depending on your credit profile. Zip simplifies the process by splitting your purchase into four equal payments over six weeks. A $335 tire purchase through Zip requires four $85.25 payments every two weeks. These plans work best for customers who want predictable payment schedules and can pay off balances quickly.

Lease-to-own arrangements provide access to quality tires without traditional credit requirements. Progressive Leasing, Snap Finance, and Katapult operate on a rental model where you make regular payments toward eventual ownership. The approval process focuses on income verification, valid ID, and an active bank account rather than credit scores. Most programs feature 10-12 month terms with initial payments starting at just $1. The key advantage: early buyout options within 90-101 days can significantly reduce your total cost.

Credit-based financing through store credit cards or third-party lenders offers structured repayment for customers with established credit. The Discount Tire Credit Card provides promotional financing for 6, 9, or 12 months on qualifying purchases. Goodyear's Credit Card extends up to 6-month financing on purchases of $250 or more. These arrangements feature fixed monthly payments and often include promotional periods like deferred interest, making them ideal for building credit through consistent on-time payments.

Several financing partners specialize in serving customers with limited or challenged credit histories. RimTyme's "Everyone's Approved" program requires minimal down payments—often as little as $50—to get you rolling on new tires. PayPair connects customers with multiple partners offering payment plans without traditional credit requirements. Applications focus on basic information verification rather than credit scoring, enabling nearly instant approval decisions. These options typically feature weekly or bi-weekly payment schedules that align with your payday for easier budgeting.

Ready to explore your options? Performance Plus Tire's financing programs connect you with solutions for various credit situations, helping you find the perfect balance between affordability and quality tires.

The tire financing marketplace features several major providers, each offering distinct terms and qualification processes. Understanding these differences helps you select the payment solution that matches your specific needs.

PayPair operates as a financing connection service rather than a direct lender, matching tire shoppers with multiple financing partners through one application. This approach eliminates multiple credit inquiries when seeking approval options. Your application information remains secure and typically won't affect your credit score. After submitting a quick form, PayPair instantly connects you with compatible payment options based on your profile. Most PayPair partners include early buyout options between 90-101 days, potentially reducing your total cost substantially.

Affirm offers transparent financing with rates from 0-36% APR based on your credit profile. They provide various payment structures including interest-free "Pay in 4" installments every two weeks or extended monthly payments spanning 3-12 months. For larger purchases over $1,000, Affirm extends payment terms up to 18 months. Their approval process uses a soft credit check that won't impact your score when checking eligibility. An $800 purchase might cost approximately $57.77 monthly over 12 months at 15% APR.

Snap Finance uses proprietary algorithms that look beyond traditional credit scores, making approvals accessible for challenged credit histories. Their standard agreement provides 12 months toward ownership with approval amounts typically between $300-$5,000. Katapult provides lease-to-own solutions without credit checks, featuring a 60-second application process and approvals up to $3,500. Their flexible payment schedule aligns with your payday timing. Koalafi promotes "no credit needed" lease options while reporting payment history to credit bureaus, potentially helping rebuild credit through on-time payments.

Interest rates vary significantly across providers—from 0% promotional offers to 36% APR depending on creditworthiness. Early buyout options become crucial considerations when comparing total costs. Most lease-to-own programs offer 90-day (Snap, Progressive, Katapult) or 101-day (Own) purchase options that substantially reduce total costs. Down payment requirements remain minimal across providers—many offer "no money down" programs while others require initial payments as low as $1. Repayment flexibility varies among providers, with terms ranging from short 3-month periods to extended 60-month arrangements based on purchase amount.

Choosing the right tire payment plan requires evaluating key factors that go beyond monthly payment amounts. With various financing options available, understanding the details ensures you get the best arrangement for your situation.

Tire financing programs maintain straightforward qualifications focused on verifying your identity and payment ability. You'll need to be at least 18 years old, have a valid government-issued photo ID, and demonstrate monthly income of at least $1,000. For applications, be prepared to provide:

Name, address, and contact information

Social Security Number (sometimes just the last four digits)

Income verification

Active checking account (usually open 90+ days)

Early buyout options represent your greatest opportunity for savings with most financing partners. Most providers offer early purchase windows between 90-101 days. You can pay off your balance during this period and potentially avoid additional fees. Many providers feature "90-day same as cash" arrangements where you pay only the product price without extra costs. To use this option effectively, you must make payments larger than your regular scheduled amounts to ensure your account is paid off by the deadline.

Examine all potential charges before committing to any financing arrangement. Common hidden costs include processing fees ($50-$200), origination fees (1-3% of loan amount), and setup costs. Promotional deals often jump to high rates exceeding 20% APR if not paid within the promotional period. Before signing, ask these important questions: Are there early payment penalties? What happens if a payment is late? Will ownership transfer at the end of the agreement?

Coordinate payment timing with your income schedule to prevent cash flow problems. Companies like Katapult adjust your payment schedule based on when you receive your paycheck, offering weekly, biweekly, or monthly options. This approach minimizes missed payments and potential fees. For personalized financing solutions that align with your specific budget and needs, explore Performance Plus Tire's financing programs.

Tire financing makes quality tires accessible when you need them most. Whether you're dealing with worn tires or planning an upgrade, flexible payment options ensure you don't have to compromise on safety or quality.

The application process is simple and fast. Most providers deliver instant decisions without affecting your credit score, making financing available even with limited credit history.

Each financing type serves different needs. Buy now, pay later plans work well for short-term budgeting. Lease-to-own programs offer the most accessibility. Traditional installment plans help build credit history.

Early buyout options provide your best savings opportunity. Most providers offer 90-day purchase windows that can significantly reduce your total costs.

Read all terms carefully before signing. Look for hidden fees and make sure payment schedules match your income timing. This prevents missed payments and unnecessary charges.

Safety comes first when selecting tires. Financing ensures you can get quality tires now rather than waiting or settling for cheaper, potentially unsafe options. Quality tires directly impact your vehicle's performance and your safety on the road.

Ready to find the perfect tire financing solution? At Performance Plus Tire, we work with multiple financing partners to help you get the tires you need at terms that work for your budget.

Understanding tire financing options can help you get quality tires safely and affordably, even when cash is tight. Here are the essential insights to guide your decision:

• Multiple financing paths exist: Choose from buy-now-pay-later plans, lease-to-own programs, or traditional installment financing based on your credit situation and budget needs.

• Approval happens instantly: Most applications process within seconds using soft credit checks that won't impact your credit score, making financing accessible even with limited credit history.

• Early buyout saves money: Take advantage of 90-101 day purchase windows offered by most providers to pay only the product price and avoid additional fees.

• Safety justifies financing: With tire-related crashes causing 646 deaths in 2023 and half-worn tires reducing safety performance, financing ensures you don't compromise on road safety.

• Read the fine print carefully: Watch for hidden fees like processing charges ($50-$200) and understand payment schedules to avoid penalties and maximize savings.

The key to successful tire financing lies in matching payment plans to your income schedule and taking advantage of early purchase options. Whether you need emergency tire replacement or want to upgrade to premium tires, financing makes essential vehicle maintenance accessible while keeping you safely on the road.

Tire financing allows you to purchase new tires without paying the full amount upfront. Instead, you make scheduled payments over an agreed period. Options include buy-now-pay-later plans, lease-to-own programs, and traditional installment financing. Most applications are processed instantly, often without impacting your credit score.

Tire payment plans make quality tires accessible when you're on a tight budget or face unexpected tire emergencies. They help maintain steady cash flow, allow access to premium tires beyond your immediate budget, and ensure you don't compromise on road safety due to financial constraints.

Yes, many tire retailers offer financing options for those with limited or challenged credit histories. Lease-to-own programs often don't require traditional credit checks, instead evaluating factors like income stability and banking history. Some providers specialize in "no credit needed" options with minimal down payments.

To save money, take advantage of early buyout options, typically available within 90-101 days of purchase. This allows you to pay off your balance early, potentially avoiding additional fees. Also, look for promotional deals like "90-day same as cash" offers, where you only pay the product price if settled within the promotional period.

When selecting a tire financing plan, consider factors such as interest rates, repayment terms, and any hidden fees. Check eligibility requirements and ensure the payment schedule aligns with your income. Understand early buyout options and potential penalties for late payments. Most importantly, choose a plan that balances affordability with your tire needs and long-term financial goals.