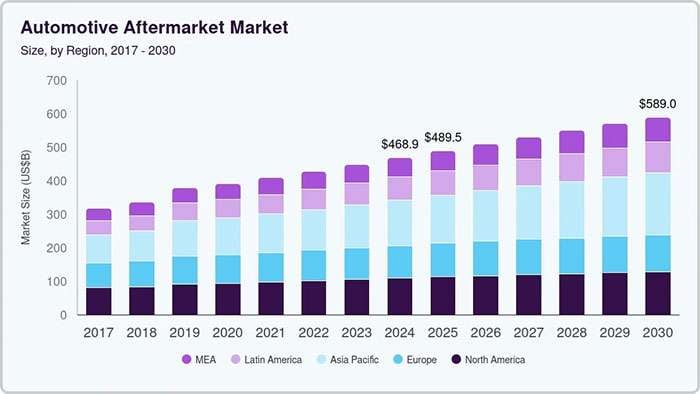

The global tire market reached USD 264.68 billion in 2024 and continues building momentum across all major segments. Industry analysts have tracked traditional growth factors for years, but seven unexpected drivers are reshaping this essential automotive sector in ways most experts failed to anticipate.

Market projections consistently point to substantial expansion, with forecasts indicating growth to USD 394.55 billion by 2030, representing a CAGR of 6.88%. The Asia-Pacific region maintains its dominant position, fueled by rapid urbanization exceeding 2.3 billion people and significant automotive sales growth. China has strengthened its global leadership, exporting tires worth $21.33 billion in 2023, up from $18.87 billion the previous year. These impressive figures represent only part of the complete picture.

We have identified seven hidden growth drivers reshaping tire market trends that most industry watchers completely overlooked. AI-driven design innovations to sustainability mandates are creating unprecedented changes in how tires are manufactured, distributed, and consumed worldwide. Understanding these overlooked factors provides essential insight into where the global tire market is heading and what opportunities lie ahead for manufacturers and distributors.

Image Source: Grand View Research

Market reports consistently show the global tire market valued at USD 264.68 billion in 2024, establishing a strong foundation for continued expansion. Industry experts project steady growth, with the market reaching approximately USD 394.55 billion by 2030.

Various market analyses present different baseline estimates—ranging from USD 143.06 billion to USD 320 billion for 2024—but all point toward substantial growth regardless of starting measurements. The Asia-Pacific region maintains its position as the dominant market force, with radial tires leading as the top tire segment by type.

Growth stems primarily from increased vehicle production across developed and emerging economies. Infrastructure development projects worldwide create heightened demand for construction equipment, boosting tire requirements across multiple sectors. This trend proves particularly strong in rapidly developing regions where urbanization accelerates.

Tire technology innovations play a crucial role in market expansion. Specialized designs including low-profile, run-flat, rimless, and environmentally friendly "green" tires contribute significantly to growth during the forecast period. These advances address changing consumer preferences while meeting increasingly strict regulatory requirements.

The global tire market is positioned to achieve a compound annual growth rate (CAGR) of approximately 6.88% between 2025 and 2030. This growth rate surpasses many other automotive component sectors, demonstrating the tire industry's strength and adaptability.

Key factors driving this growth trajectory include:

Electric Vehicle Revolution: The expanding electric vehicle industry represents a major catalyst for tire manufacturers. Government initiatives worldwide aimed at reducing carbon emissions accelerate EV adoption, driving demand for specialized EV tires. The global electric vehicle tires market shows remarkable expansion potential, with projections indicating growth from USD 22.64 billion in 2023 to USD 128.00 billion by 2030, representing an exceptional CAGR of 28.07%.

Urbanization Effects: Rapid urbanization across developed and developing nations generates significant demand for passenger and commercial vehicles. Urban expansion necessitates robust transportation infrastructure, stimulating tire market growth across multiple segments.

Technology Advances: Smart tires equipped with IoT sensors for real-time monitoring of tire pressure, tread wear, and road conditions gain traction, especially in premium vehicle segments.

Sustainability Focus: Environmental concerns influence manufacturing approaches, with increased emphasis on bio-based materials, recycled rubber, and energy-efficient production methods. Green tires containing eco-friendly carbon black compounds offer reduced rolling resistance, improved fuel efficiency, and enhanced wet traction performance.

The North American EV tire market illustrates regional growth patterns, with valuations reaching USD 5.9 billion in 2024 and projections suggesting expansion to USD 13.9 billion by 2034 at a 9.2% CAGR. This regional trend reflects broader global patterns of specialized tire segment growth.

The global tire market demonstrates strong growth prospects driven by multiple factors—from technological innovation to changing consumer preferences and regulatory frameworks—all working together to reshape this essential automotive component industry.

Image Source: smart-tires.com

Smart tire technology represents a game-changing force reshaping commercial fleet operations across the industry. These advanced systems deliver continuous data-driven insights that transform fleet maintenance, safety, and profitability in ways conventional tires simply cannot match.

Sophisticated sensors embedded within tire casings collect vital performance metrics every 4-5 seconds, transmitting data wirelessly to fleet management systems. These intelligent monitoring systems track multiple critical parameters simultaneously:

Tire pressure and temperature readings

Tread depth measurements and wear patterns

Load distribution analysis

Vehicle location tracking

Mileage accumulation statistics

Smart tire sensors deliver exceptional precision because they attach directly to the inner tire casing rather than valve stems, generating remarkably accurate readings. This continuous stream of performance data creates an early warning system for fleet managers, enabling intervention before minor issues escalate into costly problems.

Continental's ContiConnect demonstrates this advancement effectively, capturing tire performance metrics while keeping fleet managers informed of changes in real-time. Michelin's Smart Predictive Tire solution combines trailer tracking with tire monitoring capabilities, providing a comprehensive view of fleet assets.

Traditional fleet maintenance follows reactive approaches—addressing problems after they occur. Smart tire technology enables a fundamental shift toward predictive maintenance strategies that anticipate issues before they cause expensive downtime.

The operational improvements prove impressive. Fleet operators implementing smart tire systems report 70-90% fewer emergency roadside service calls and 15-20% extended tire life. Predictive maintenance reduces equipment downtime by 30-50% and extends component life by 20-40%.

The financial impact delivers substantial value. Smart tire systems generate approximately $2,000 annual savings per truck. Michelin reports their Smart Predictive Tire solution helps extend overall tire life by 9%. Preventing emergency roadside service events delivers notable operational benefits—Michelin's solution helps prevent up to 80% of ERS incidents.

These systems significantly impact fuel efficiency as well. Properly inflated tires reduce fuel consumption by up to 4%. The Environmental Protection Agency confirms low rolling resistance tires reduce costs and emissions for long-haul Class 8 tractor-trailers by 3% or more. The Department of Energy estimates tire rolling resistance accounts for 4-11% of total fuel consumption.

The real power of smart tire technology emerges when integrated with broader telematics and fleet management systems. This integration transforms isolated data points into actionable intelligence that drives operational decisions.

Modern systems provide comprehensive reporting capabilities:

Time-to-Critical alerts predicting when tire pressure will reach critical levels

Prioritized service action lists for maintenance teams

Normalized pressure readings (cold pressure) to ensure peak fuel efficiency

Tire temperature monitoring to identify potential brake or mechanical issues

Connecting smart tire data with existing platforms requires careful implementation planning. While APIs exist for popular systems like Samsara, Verizon Connect, and Trimble, many fleets initially struggle with excessive alerts lacking clear action steps. Advanced systems now filter this data through AI algorithms that aggregate, analyze, and report meaningful insights.

Smart tire technology functions as both a preventive maintenance tool and a real-time safety system. By detecting potentially dangerous conditions immediately rather than waiting for visual inspections, these systems enhance fleet safety profiles and reduce CSA violations.

This hidden driver propels global tire market growth through increased value-added services and higher margins on specialized sensor-equipped products—creating new revenue streams that extend far beyond traditional tire sales.

Artificial intelligence has quietly emerged as a game-changing force in the global tire market, fundamentally changing how tires are designed, manufactured, and customized. Traditional design methods relied on manual iteration and extensive testing, but AI-driven approaches enable tire manufacturers to rapidly optimize designs for specific performance needs.

Tire tread patterns historically required painstaking manual design work coupled with extensive physical testing. Today, deep generative frameworks have transformed this process by automatically creating various tread patterns that meet target tire performance specifications. These sophisticated systems employ generative adversarial networks (GANs) alongside 2D image-based tire performance evaluation functions to produce optimized designs.

One particularly effective application involves using adaptive immune genetic algorithms (AIGA) specifically designed for tire pitch parameters. When compared to traditional genetic algorithms, AIGA demonstrated markedly improved convergence and efficiency, resulting in reduced tread pattern noise levels.

Continental and other major manufacturers have implemented AI solutions that:

Analyze driving patterns and road conditions through advanced algorithms

Customize tire designs for specific terrains and usage profiles

Enhance performance and safety across diverse environments

Optimize tread patterns for noise reduction and improved grip

The most intriguing developments involve "morphing tire" technology, where AI-integrated approaches enable real-time terrain sensing. These systems utilize shape-memory alloys and elastomers to create adaptive tread patterns that automatically adjust to different surfaces—highways, off-road terrains, icy roads, and wet conditions.

Predicting tire wear has long challenged the industry due to the complex interplay of vehicle characteristics, driving conditions, and tire composition. Machine learning algorithms now tackle this problem by processing data from embedded sensors that monitor tire conditions in real-time.

Recent research shows remarkable progress in this area. One study developed a tire wear state recognition module using accelerometers and PVDF sensors, integrating signal preprocessing with convolutional neural networks (CNN). This system accurately identified different tire wear levels, demonstrating excellent robustness under varying loads, tire pressures, and speeds.

Another breakthrough approach utilizes 1D-CNN for extracting acceleration-related bottleneck features (AC) to predict tire wear. When combining these features with wheel travel speed, wheel rotational speed, tire internal pressure, and vertical load data, researchers achieved an impressive 1.3% (0.21mm) average error in predicting wear amounts.

Even without acceleration data, models using only vehicle-mounted sensors and Tire Pressure Monitoring Systems (TPMS) achieved remarkably similar accuracy—a 2.1% (0.34mm) error rate. This suggests viable implementation paths without requiring extensive sensor retrofitting.

The automotive industry has embraced these advances, with researchers proposing experimental-based tire wear life prediction methods that achieve practical accuracy early in vehicle development cycles without requiring time-consuming and costly real vehicle tests.

JK Tire & Industries exemplifies successful real-world implementation of AI-driven tire design. The company strategically deployed AI and ML technologies to enter India's high-end car segment with its Levitas Ultra range in 2023.

The ₹8000-crore company leveraged simulation technology through artificial intelligence and machine learning to design Ultra High Performance (UHP) tires specifically formulated with high-grade MFX Polymer. These tires address unique challenges of Indian roads while providing stability during hard cornering.

According to Anuj Kathuria, JK Tire's President: "When designing the grooves for the tire for water wading capability to avoid aquaplaning, data is continuously required to work and improve upon. So, the simulations that have to be done and the algorithms that have to be hit are all done via AI and ML".

JK Tire has since established a Digital & Analytics Center of Excellence staffed by approximately 70 engineers and data scientists. Their Managing Director, Anshuman Singhania, reinforced this commitment in company filings for FY25: "Digital transformation and AI-driven processes are at the heart of our growth strategy".

The company has integrated machine learning, Industrial Internet of Things (IIoT), and QR-code based tire genealogy into manufacturing processes, primarily for passenger car radial tires. These implementations have improved first-time quality, reduced scrap, and enhanced overall process efficiency.

AI-driven tire design and customization represent a critical yet underappreciated driver of global tire market growth—promising continued innovation as algorithms and computational capabilities advance.

Image Source: Michelin North America

Electric vehicles demand entirely different tire designs than conventional internal combustion engines. This often overlooked aspect of the global tire market creates a specialized product category with unique engineering challenges and exceptional growth trajectories. The EV tire segment projects growth from USD 11.21 billion in 2025 to USD 27.63 billion by 2032, at an impressive CAGR of 13.6%.

Battery range concerns drive EV owners' tire selection decisions. Low rolling resistance tires minimize friction between tire and road surface, extending maximum distance from battery packs. The performance gains prove substantial:

Low rolling resistance designs boost EV driving range by 4–7%

Michelin's e.Primacy provides up to 32 kilometers additional range compared to leading competitors

Properly inflated tires reduce energy consumption by up to 4%

Switching to standard tires can cut efficiency by 15%, a significant loss for range-conscious drivers. Tire manufacturers have prioritized compound development specifically for electric vehicles. Michelin's GreenPower Compound exemplifies this focus, designed to reduce energy consumption during everyday use while delivering extended mileage.

Engine noise masking disappears in electric vehicles, making tire noise far more noticeable. Manufacturers have developed innovative solutions addressing this challenge.

"Tire noise essentially competes with the noisier engine in ICE vehicles. EVs make tire noise more noticeable," explains Michelin. Company testing shows approximately 50% of noise in combustion vehicles comes from the powertrain, while tire noise constitutes about 40% of total vehicle noise in EVs.

Manufacturers respond with proprietary technologies:

Sound-Absorbing Foams: Polyurethane foam blocks inside tire cavities reduce air resonance by up to 50%. Nokian's SilentDrive Technology utilizes acoustic foam calibrated to absorb specific frequencies most detectable by human ears.

Tread Pattern Engineering: Hankook's pattern noise reduction technology suppresses screeching during braking and directional changes, reducing noise by 0.8dB compared to previous products.

Specialized Tire Construction: Michelin's Piano Acoustic Technology uses optimized tread patterns that reduce noise throughout the tire's lifespan.

EV tires must accommodate substantially heavier vehicles. Manufacturers developed High Load (HL) tires capable of handling higher air pressure for increased weight-bearing capacity without requiring larger wheel wells. This innovation prevents the need for physically larger tires that would reduce energy efficiency and cabin space.

Major manufacturers rapidly expand EV-specific tire offerings. Bridgestone's Turanza EV, launched in 2023, represents the company's first replacement tire designed specifically for premium electric vehicles. Key features include:

ENLITEN technology optimizing all-season performance and wear life

QuietTrack technology embedded in tread design to reduce road noise

50,000-mile limited warranty with next-generation tread compound featuring PeakLife polymer technology

Michelin introduced the e.Primacy All Season tire in February 2025. This product delivers impressive performance metrics:

Up to 25% greater efficiency than two leading competitors

21,000 kilometers longer life compared to two leading competitors

Cushion Guard technology with soft cushioning layer between tread and steel belts to absorb road impacts

The EV tire space continues attracting innovation. Goodyear launched the Electric Drive 2 in January 2024 for electric passenger cars including Tesla Model 3 and Ford Mustang Mach-E, featuring low rolling resistance and noise reduction through SoundComfort Technology. Pirelli introduced the P Zero Fifth Generation in May 2025, engineered specifically for electric vehicles with AI-driven tread patterns.

Focused engineering addressing unique EV requirements creates an entirely new product segment that promises to constitute an increasingly important portion of the global tire market.

Image Source: ColorWhistle

Online shopping has changed the tire industry landscape, creating new distribution models that many traditional dealers didn't see coming. The global automotive tires e-retailing market reached USD 16.4 billion in 2024 and is projected to expand at an impressive 13.6% CAGR through 2034.

Major tire manufacturers have discovered the value of building direct relationships with their customers. Goodyear, Michelin, and Bridgestone now sell tires directly through their websites, giving them better control over how customers experience their brands. This strategic move goes beyond just adding another sales channel—it's reshaping how tires reach consumers.

The numbers tell the story clearly: e-commerce sales of replacement tires grew 45% over just three years, showing a permanent shift in consumer preferences. Industry research revealed that more than 75% of buyers now prefer remote engagement over face-to-face interactions, accelerating this trend even further.

The "Buy Online, Fit Offline" (BOFO) model has solved a critical challenge for online tire buyers. Smart retailers have built extensive service networks that bridge the gap between digital shopping and professional installation:

Many retailers now partner with 10,000+ installation centers nationwide

Mobile fitting services bring installation directly to customers' locations

Platforms like TireConnect integrate financing options directly into the purchase process

Goodyear exemplifies this approach by selling tires online and arranging professional installation at customers' homes or workplaces. This integration addresses what was previously the biggest obstacle for online tire retailers—getting tires properly mounted and balanced.

Online channels now represent 14% of all replacement tire sales, up dramatically from just 9% in 2019. Consumer demand for convenience continues driving this acceleration across the market.

The suspension system segment—tires specifically—captured 26.64% of 2024 e-commerce automotive aftermarket revenue. Transparent pricing combined with seamless local installation scheduling appeals strongly to digital shoppers.

The average price of tires sold online increased by 54% over three years, compared to just 32% for in-store purchases. This suggests online buyers prioritize convenience and selection over finding the lowest possible price.

E-commerce has become a powerful yet overlooked driver reshaping global tire market distribution channels and creating new opportunities for both manufacturers and retailers.

Specialty tire segments are quietly creating new growth opportunities across the global tire market. While mainstream passenger tires get most attention, these niche categories deliver impressive growth rates that many industry watchers miss entirely.

The off-road tire sector has experienced remarkable expansion, reaching USD 495.5 billion in 2024, with projections indicating growth to USD 987.14 billion by 2034, representing a steady CAGR of 7.13%. This growth stems from increased construction activities, infrastructure development, and rising farm mechanization across emerging economies.

Off-road tires require specialized engineering to handle demanding conditions:

Reinforced sidewalls for puncture resistance

Deep treads for optimal grip in challenging terrains

Robust construction supporting heavy loads

Agricultural applications show particular promise as global population growth pushes farms toward mechanization. Specialty tires designed for tractors, combines, and farming equipment provide essential support for food production systems worldwide, minimizing soil compaction through advanced designs.

These tires must withstand harsh operating conditions while protecting valuable farmland. Manufacturers have responded with innovative tread compounds and construction methods that extend service life while reducing environmental impact.

The high-performance motorcycle tire market demonstrates strong growth potential. Currently valued at USD 3.26 billion in 2025, this segment projects a 6.2% CAGR through 2033. Growth comes primarily from increasing motorcycle popularity among younger demographics and emerging economies.

Market concentration remains moderate, with the top ten manufacturers accounting for approximately 65% of total consumption value, estimated at USD 2.50 billion in 2023. Bridgestone, Michelin, and Pirelli maintain significant advantages through extensive distribution networks.

Manufacturers continue advancing technology in key areas:

Enhanced wet-grip capabilities

Extended tire lifespans

Improved fuel efficiency

Performance motorcycle riders demand tires that deliver exceptional grip, precise handling, and reliable performance across varying conditions. This creates opportunities for premium products with higher margins.

Electric vehicles have created an entirely new specialty tire category with unique engineering requirements. Consumer Reports testing revealed that standard all-season tires often outperform EV-specific original equipment tires in critical safety areas including wet braking, snow and ice grip, and hydroplaning resistance.

This finding highlights important market dynamics: over 30% of EV owners replace their tires sooner than expected, with more than half doing so before reaching 30,000 miles. Among replacement tire buyers, roughly 66% choose models different from original equipment specifications.

EV tires address specialized requirements:

Weight management (EVs are heavier due to battery packs)

Torque handling (instant torque from electric motors)

Noise reduction (interior noise can be up to 9 decibels lower with specialized designs)

These specialty segments represent significant growth opportunities as manufacturers develop increasingly specialized products for distinct vehicle categories and specific use cases. The key lies in understanding unique performance requirements and delivering solutions that address real customer needs.

Manufacturing dynamics across the global tire market are experiencing significant geographic shifts. Emerging production hubs continue asserting their influence through remarkable export growth and regional specialization patterns that many industry observers have underestimated.

The Asia-Pacific region holds its position as the global tire market powerhouse, driven largely by China's outstanding export performance. Chinese semi-steel tire exports, primarily for passenger vehicles, surged by 20% year-on-year to reach 287 million units in 2023. The country's total tire exports hit USD 21.33 billion in 2023, up substantially from USD 18.87 billion in 2022. This export surge stems from Chinese tires' competitive pricing advantage during inflation pressures across European and American markets.

Chinese manufacturers actively expanded their overseas production capabilities throughout 2023-2024. Sentury established a new production base in Morocco scheduled to begin operations in Q4 2024, while Sailun planned a USD 240 million joint venture in Mexico focused on semi-steel tire production.

India's natural rubber production demonstrates steady growth, increasing 8.6% from 7.89 lakh ton in FY21-22 to 8.57 lakh ton in FY23-24, with projections reaching 8.82 lakh ton by FY24-25. This growth partially addresses India's total rubber consumption of 14.16 lakh ton, though a gap of approximately 5.5 lakh ton remains.

The northeastern states have emerged as important production regions, with their collective share in total production more than doubling to 17.5% in 2023-24 from just 7.8% in 2013-14. Tripura's production alone increased to 91,500 ton from 39,000 ton over a decade.

NEXEN TIRE exemplifies the industry's regional diversification strategy through new offices across Europe, Latin America, and the Middle East. The company established a Mexican subsidiary serving as an independent business unit for Latin America, capitalizing on Mexico's record-high vehicle registrations in 2024.

NEXEN TIRE plans expanded operations throughout Central America, including Honduras, Guatemala, Costa Rica, and El Salvador. Its Middle East strategy builds upon existing operations in Dubai and Egypt with a new Saudi Arabian subsidiary targeting neighboring markets like Qatar, Bahrain, and Yemen.

These regional manufacturing shifts create new supply chain dynamics while offering manufacturers opportunities to serve local markets more effectively. The trend toward localization helps companies reduce shipping costs, avoid trade restrictions, and respond more quickly to regional market demands.

Image Source: Rubber News

Sustainability initiatives have become a powerful force reshaping the global tire market, with manufacturers working to meet environmental targets through material innovation and new production methods.

Pirelli leads this shift with the industry's first standard production tire containing over 70% bio-based and recycled materials. Their design incorporates FSC™-certified natural rubber, recycled steel from scrap metal, and rice husk-derived silica obtained from processing waste. Michelin aims to produce tires from 100% sustainable sources by 2050, while Continental reports 26% renewable and recycled materials in 2024 production, targeting 40% by 2030.

These advances address growing consumer demand for environmentally responsible products. Manufacturers are finding that sustainable materials often perform as well as traditional compounds while reducing environmental impact throughout the tire's lifecycle.

The Department of Energy estimates that tire rolling resistance accounts for 4-11% of total fuel consumption. Industry studies confirm a 10% reduction in rolling resistance yields approximately 1% improvement in fuel economy. For consumers, this translates to real savings at the pump over a tire's service life.

Beyond fuel savings, low rolling resistance tires help fleet operators reduce operating costs and meet corporate sustainability goals. These specialized compounds maintain performance while delivering measurable efficiency improvements across different vehicle types and driving conditions.

Regulatory frameworks increasingly mandate sustainable practices across the tire industry. California regulations specifically require low rolling resistance tires on certain trucks, while Extended Producer Responsibility policies make manufacturers accountable for products' entire lifecycles.

The U.S. tire manufacturing industry has embraced these challenges, pursuing legislation like H.R. 3401 to incentivize tire retreading—a process that reduces CO2 emissions by 24%, water consumption by 19%, and keeps 1.4 billion pounds of waste out of landfills annually. This circular approach creates value for both manufacturers and consumers while addressing environmental concerns.

We see sustainability mandates creating new opportunities for tire manufacturers to differentiate their products and capture market share through innovative materials and production processes.

The global tire market has reached a turning point, driven by seven overlooked factors that most industry watchers missed completely. These hidden drivers are reshaping how tires are designed, manufactured, and sold across the world.

Smart tire technology delivers real-time monitoring and predictive maintenance capabilities that save fleet operators $2,000 annually per truck while reducing emergency service calls by 70-90%. AI-powered design processes enable manufacturers to optimize tread patterns and predict tire wear with remarkable precision, creating customized solutions for specific driving conditions.

Electric vehicle requirements have created an entirely new product category. The EV tire segment projects growth to USD 27.63 billion by 2032, reflecting the specialized engineering needed for low rolling resistance, noise reduction, and enhanced load-bearing capabilities. Meanwhile, online tire retailing has captured 14% of replacement tire sales, up from just 9% in 2019, as consumers embrace the convenience of digital purchasing with integrated fitment services.

Specialty segments continue expanding beyond traditional markets. Off-road tires reached USD 495.5 billion in 2024, while high-performance motorcycle tires maintain steady growth at 6.2% CAGR through emerging market adoption and technological advancement.

Regional manufacturing shifts demonstrate China's 20% year-over-year export growth in semi-steel tires, reaching 287 million units in 2023. India's natural rubber production has grown 8.6% to support expanding tire manufacturing capabilities, while companies like NEXEN TIRE establish new operations across Latin America and Africa.

Sustainability mandates are driving unprecedented material innovation. Pirelli produces tires with over 70% bio-based and recycled content, while manufacturers pursue 100% sustainable sourcing by 2050. Low rolling resistance designs reduce fuel consumption by 4-11%, directly supporting environmental goals and cost savings for consumers.

These seven drivers work together to propel market growth toward USD 394.55 billion by 2030. Companies that recognize and adapt to these changes will secure competitive advantages in an industry experiencing fundamental shifts across technology, sustainability, and customer engagement. The tire market's future belongs to manufacturers and distributors who understand these hidden forces and position themselves accordingly.

The global tire market is experiencing unprecedented growth driven by seven overlooked factors that are fundamentally reshaping the industry beyond traditional expectations.

• Smart tire technology is revolutionizing fleet operations with embedded sensors providing real-time monitoring, reducing emergency service calls by 70-90% and generating $2,000 annual savings per truck.

• AI-driven design optimization enables manufacturers to create customized tread patterns and predict tire wear with 98.7% accuracy, transforming traditional manual design processes.

• EV-specific tire engineering addresses unique electric vehicle requirements like low rolling resistance and noise reduction, with the EV tire market projected to reach $27.63 billion by 2032.

• Online tire retailing has captured 14% of replacement tire sales, up from 9% in 2019, with integrated fitment services solving installation challenges for digital consumers.

• Sustainability mandates are driving innovation in bio-based materials and recycled rubber usage, with manufacturers like Pirelli creating tires with over 70% sustainable content.

• Regional manufacturing shifts show China's semi-steel tire exports surging 20% year-over-year while India expands natural rubber production, reshaping global supply chains.

These hidden drivers collectively propel the market from $264.68 billion in 2024 toward $394.55 billion by 2030, creating new revenue streams and competitive advantages for companies that recognize and adapt to these emerging trends.

The global tire market is experiencing growth due to several factors, including the rise of electric vehicles, advancements in smart tire technology, AI-driven design innovations, increasing online tire sales, and a focus on sustainability. These drivers are reshaping how tires are manufactured, distributed, and used across various vehicle categories.

Smart tire technology is revolutionizing commercial fleet operations by providing real-time monitoring of tire conditions. This enables predictive maintenance, reducing emergency roadside service calls by 70-90% and generating annual savings of approximately $2,000 per truck. The technology also improves fuel efficiency and overall fleet safety.

AI is transforming tire design by optimizing tread patterns, predicting tire wear, and enabling customization for specific driving conditions. AI algorithms can analyze vast amounts of data to create tire designs that meet target performance specifications more efficiently than traditional manual methods. This leads to improved tire performance, safety, and longevity.

Electric vehicles require specialized tires due to their unique characteristics such as higher weight and instant torque. Tire manufacturers are developing EV-specific tires with low rolling resistance to extend battery range, enhanced load-bearing capacity, and noise reduction features. The EV tire market is projected to grow significantly, reaching $27.63 billion by 2032.

The tire industry is increasingly focusing on sustainability through various initiatives. These include developing tires with bio-based and recycled materials, improving fuel efficiency through low rolling resistance designs, and implementing circular economy practices. Some manufacturers aim to produce tires from 100% sustainable sources by 2050, while others are already incorporating over 70% sustainable content in their products.