Can you finance wheels and tires when your budget doesn't stretch far enough for that full set you need? Absolutely!

We offer the best selection of wheel and tire financing options at terms that won't break the bank. With approval amounts up to $6,500 and financing available for all credit situations, getting the wheels and tires you want has never been easier. Our financing partners provide flexible payment plans including 0% financing options that charge NO interest over the life of your loan. Many providers offer 90-day same-as-cash options with no additional fees if you complete payment within that timeframe.

What makes these financing options even better is that you can get approved for rims and tires with bad credit or no credit history at all. Most providers welcome all credit types and provide instant decisions when you apply online. Drive away with new wheels today with initial payments as low as $0-$59.

We have financing solutions for every situation, including lease-to-own and no-credit-needed programs. Whether you're looking for custom wheels, off-road rims, or complete wheel and tire packages, our financing options make it possible to get what you want without the wait. This guide covers everything you need to know about financing your next wheel and tire purchase.

New wheels and tires typically cost between $800 to $1,000 for a complete set. Financing makes this essential purchase manageable without compromising on quality or safety.

Tire emergencies don't wait for your next payday. Bald tires, sidewall blowouts, and unexpected damage create immediate safety concerns. Quality tires improve your vehicle's road grip, cornering ability, and braking performance.

Financing eliminates the difficult choice between draining your savings and addressing critical safety needs. You can prioritize safety without waiting months to save the full amount.

Financing turns that large one-time expense into manageable monthly payments. Payment terms range from 3 to 36 months, allowing you to choose what fits your financial situation. Most financing plans require only a small initial payment between $0 and $59.

Monthly payments fit smoothly into your existing budget compared to a sudden $800 to $1,000 expense. This approach keeps your emergency fund intact while ensuring your vehicle performs safely.

Premium wheels and tires deliver superior performance, enhanced safety, and longer service life. Quality products provide better value through:

Longer lifespan, reducing long-term replacement costs

Better handling, braking, and enhanced safety features

Improved fuel efficiency that saves money on gas

With approval amounts reaching up to $6,500, financing opens the door to quality upgrades that improve your driving experience. Qualified buyers can secure 0% financing options, providing interest-free access to premium products.

When you're ready to explore your options, browse our extensive selection of wheel and tire packages to find the perfect combination for your vehicle and driving needs.

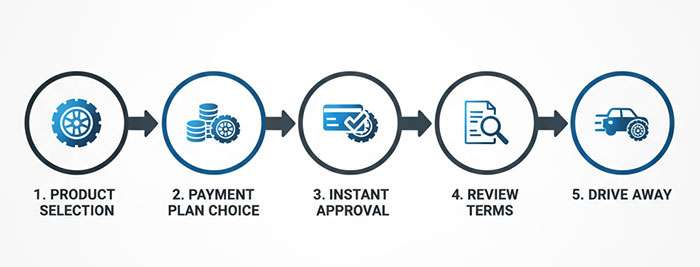

Getting financing for your new wheels and tires takes just minutes to complete. Most retailers have streamlined their approval systems to make the process quick and hassle-free. Here's exactly how it works.

Start by browsing wheels and tires that match your vehicle's specifications. Most online retailers let you shop by make, model, and year to ensure proper fitment. When you find the right match, add your selected products to your cart. Some sites offer pre-qualification that shows your approval amount upfront, so you can shop confidently within your budget. Browse complete wheel and tire packages at Performance Plus Tire to find options that suit both your vehicle and style preferences.

At checkout, you'll see several financing options designed for different credit situations. Common providers include Affirm (installments), Progressive, Snap, and Acima (lease-to-own). Compare terms by checking initial payment requirements (typically $0-$59), maximum approval amounts (up to $6,500), interest rates (including 0% options), and repayment terms ranging from 3-36 months.

The application process is simple and fast. Most applications take just minutes to complete and return instant decisions. You'll need to provide basic information such as:

Personal details (name, address, phone)

Income information

Social security number

Date of birth

Many providers use soft credit checks during pre-qualification, which won't affect your credit score.

Before completing your purchase, carefully review all terms—especially payment schedules and early buyout options. Many financing partners offer early purchase windows between 90-101 days that can significantly reduce your total cost. When you're satisfied with the terms, accept the agreement, complete your purchase, and arrange for delivery or installation of your new wheels and tires.

Credit concerns often stop people from pursuing financing for wheels and tires. The good news is that the financing landscape has changed dramatically in recent years.

The answer is no. More than a third of independent tire dealers now offer no-credit-check financing options. This shift makes sense when you consider that 35% of Americans don't qualify for traditional financing based on FICO scores. Alternative financing methods have become popular, giving options to borrowers who were traditionally considered high-risk. Many providers use soft credit checks that won't affect your score during the application process.

Credit challenges don't have to stop you from getting the wheels and tires you need. Lease-to-own programs offer a practical solution with an "Everyone's Approved" approach, making essential vehicle maintenance accessible regardless of past financial difficulties. Research shows 31% of consumers with credit scores below 670 couldn't have purchased tires without financing. Providers like Progressive Leasing, Snap Finance, and Acima specialize in serving customers with challenging credit histories, with approval amounts typically ranging from $300 to $5,000.

Alternative lenders consider several factors besides your credit score when making approval decisions:

Steady employment (usually 6+ months at current job)

Sufficient income (typically 3x the monthly payment)

Banking history and account information

Debt-to-income ratio under 40%

Most applications require basic documentation including government ID, proof of income, and residence verification. The application process is straightforward and designed to help you get approved quickly.

Selecting the right financing partner can make the difference between affordable payments and unnecessary costs. Here's what you need to consider before making your decision.

Interest rates for wheel and tire financing typically range from 0-36% APR. A $950 purchase might cost $88.15 monthly for 12 months at 20% APR. Bread Pay offers installment loans with terms from 3 to 48 months. Repayment flexibility varies significantly across providers with payment durations ranging from 3 to 60 months.

When comparing options, look at the total cost over the life of the loan, not just the monthly payment. A longer term might reduce your monthly payment but increase your total cost.

Most major financing partners provide early buyout options—typically between 90 and 101 days. This feature can deliver substantial savings. With PayTomorrow's 90-day early buyout option, you pay only the cost of merchandise plus sales tax. Taking advantage of the 90-day purchase option will save you the most money.

We recommend choosing providers that offer these early purchase windows if you think you might pay off your balance quickly.

Maximum approval amounts vary considerably:

PayTomorrow: up to $5,000

FlexShopper: up to $250,000

General range: $1,750 to $5,000+

Initial payments remain minimal across options, typically between $0-$59.

Make sure the approval limit meets your needs, especially if you're considering premium wheels or complete vehicle upgrades.

Customer service becomes crucial if you encounter issues with your financing arrangement. Tire Agent, for instance, earned praise for making things right after initial problems—offering refunds and discounts.

Research provider reviews and support policies before committing. Look for companies that stand behind their financing programs and work with customers when problems arise.

Financing wheels and tires gives you the power to upgrade your vehicle without waiting or compromising your budget. We've shown you how accessible these options have become, with financing available for all credit situations and approval amounts reaching up to $6,500. You can drive away with new wheels and tires today instead of waiting months to save the full amount.

Safety drives the real value here. Quality tires provide better grip, handling, and braking that protect you and your passengers. Financing lets you address safety needs immediately while spreading payments over 3 to 36 months to fit your budget and preserve your emergency savings.

The process works exactly as we've outlined. Select your products, choose a payment plan, apply online, and get an instant decision within minutes. Credit challenges don't have to stop you—specialized programs welcome all credit types and financial situations.

Early buyout options between 90-101 days can save you significant money on your total cost. Read the terms carefully before signing any agreement. We encourage you to explore our extensive selection of wheel and tire packages at Performance Plus Tire where you'll find the perfect combination for your vehicle with flexible financing that works for you.

At Performance Plus Tire, we understand that upgrading your wheels and tires enhances both performance and safety. Our financing solutions make it possible to get what you need when you need it. Your perfect set of wheels and tires is waiting, and you now have the knowledge to finance them with confidence.

Yes, you can finance wheels and tires with flexible payment options that make essential vehicle upgrades accessible regardless of your credit situation.

Financing is available for all credit types - Get approved for up to $6,500 with options for bad credit or no credit history through lease-to-own programs.

Start driving today with minimal upfront costs - Initial payments range from $0-$59, allowing you to get new tires immediately instead of waiting months to save.

Take advantage of 0% financing and early buyout options - Many providers offer interest-free terms and 90-day purchase windows that can significantly reduce total costs.

Safety shouldn't wait for savings - Quality tires improve braking, handling, and road grip, making financing a smart choice for immediate safety needs.

Compare terms carefully before committing - Interest rates range from 0-36% APR with payment terms from 3-36 months, so shop around for the best deal.

The financing process is straightforward: select your products, choose a payment plan at checkout, apply online for instant approval, and drive away with new wheels and tires the same day.

Yes, you can finance wheels and tires even with bad credit. Many providers offer lease-to-own programs and no-credit-check options, making it accessible for those with challenging credit histories. Approval amounts typically range from $300 to $5,000.

Financing wheels and tires allows you to drive safer with new tires immediately, spread out payments over time, and access better brands and performance. It also helps maintain your emergency fund while addressing critical safety needs without waiting to save the full amount.

The process is straightforward: select your products, choose a payment plan at checkout, complete a quick online application, and receive an instant decision. Most applications take just minutes, and you can often drive away with new wheels and tires the same day.

Yes, many providers offer 0% financing options for qualified buyers. Additionally, some offer 90-day same-as-cash options with no additional fees if you complete payment within that timeframe. Always compare terms carefully to find the best deal.

When selecting a financing partner, compare interest rates and terms, look for early buyout options (typically between 90-101 days), check approval limits and down payment requirements, and read customer reviews. Also, consider the flexibility of repayment terms, which can range from 3 to 60 months.