Tire prices have jumped dramatically due to rising labor costs, raw materials, and transportation expenses, creating a perfect storm for drivers already feeling the economic squeeze. Auto insurance has skyrocketed by a staggering 19.5% according to the most recent Consumer Price Index data, while overall inflation has grown 3% compared to last year. These twin forces of inflation and insurance costs are reshaping tire purchases in ways many drivers are only beginning to understand.

Higher interest rates increase borrowing costs for both manufacturers and consumers. This creates more cautious consumer spending, particularly affecting vehicle maintenance purchases like new tires. The national average for full coverage car insurance now approaches $2,300 annually—about $190 monthly. This squeezes household budgets already strained by inflation and rising auto costs. Essential vehicle maintenance expenses such as oil changes and tire rotations continue weighing down finances, forcing many drivers to make tough choices about when to replace their tires.

We examine how inflation and insurance trends are reshaping tire buying decisions and what every driver should know to handle these challenging economic conditions. Understanding how inflation affects car insurance rates to learning practical strategies for maintaining your vehicle without breaking the bank—we provide the insights you need to make informed decisions in today's economy.

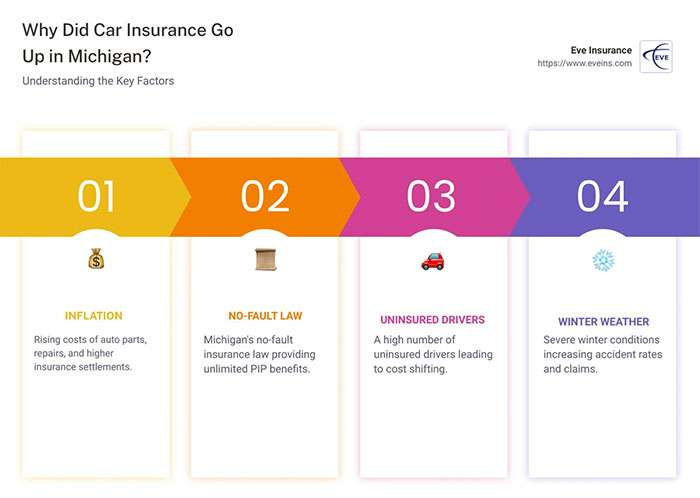

Image Source: Eve Insurance

The economic landscape for drivers has shifted dramatically. Auto insurance costs have soared by an unprecedented 18.6% for the 12 months ended in July, marking the third-largest jump in prices across all goods and categories tracked by the Consumer Price Index. This dramatic rise represents the most significant sustained increase since 1976.

The relationship between inflation and car insurance rates creates a complex web of financial pressure. Auto insurance operates as a reactionary product—insurers set rates by assessing future risk, and when losses exceed expectations, rates increase to rebuild depleted reserves. This creates a delayed effect where inflation's impact on insurance premiums typically manifests 18-24 months after price increases hit the broader economy.

Several key factors drive this connection:

Rising repair costs: Labor shortages have extended repair times, leaving insurers paying for rentals longer

More expensive parts: The cost of replacement components has increased significantly

Vehicle technology: Modern cars contain up to 3,000 semiconductor chips, with chip costs per vehicle expected to jump from $500 to $1,400 by 2028

Healthcare inflation: Insurance providers must cover injuries after crashes, making rising medical costs a significant factor

Severe weather events: Billion-dollar weather incidents have increased substantially over the past five years

Riskier driving behavior: Speeding, drunk driving, and other dangerous behaviors worsened during the pandemic

The growing involvement of attorneys in settling accident claims has created a situation where "increased attorney involvement. actually ends up with a higher payout from the insurance company, but a lower payout coming to the injured parties".

The motor vehicle insurance index, a component of the Consumer Price Index, tracks premiums for physical damage, liability, and miscellaneous coverage for private passenger vehicles. With a relative importance of 2.796 in the CPI as of December 2024, this index reveals alarming trends.

Auto insurance rates have increased by a staggering 45.8% since December 2021. Despite the overall inflation rate cooling to 3% as of January 2025, motor vehicle insurance costs still rose by 11.8% over the past year.

Industry experts forecast an additional 7% increase throughout 2025. This follows a period when insurers lost an average of 12 cents on every premium dollar collected in 2022—their worst performance in over two decades.

The ripple effect of these insurance hikes directly impacts tire purchasing decisions. As households allocate more budget to insurance premiums, less money remains available for maintenance expenses like tires. The average American household now spends about 3.39% of their median income on car insurance alone.

This financial squeeze happens precisely when proper tire maintenance matters most. Underinflated tires reduce fuel economy and increase harmful emissions. Properly inflated tires can save drivers up to 11 cents per gallon and extend tire life by approximately 4,700 miles.

The stakes are high—nearly 11,000 tire-related motor vehicle crashes occur annually, resulting in over 600 fatalities. As insurance premiums continue claiming a larger share of household budgets, many drivers postpone tire replacements or choose lower-quality alternatives.

The interplay between inflation and insurance costs has fundamentally altered the tire market landscape. As costs continue climbing, tire manufacturers and retailers must adapt their strategies while consumers face increasingly difficult purchasing decisions in this challenging economic environment.

The sticker shock at tire shops across America in 2025 is real. Drivers are paying an estimated $223 per tire—a dramatic jump from the $167 average in 2020. Installation costs have also crept upward, rising from $25 to $31. A tire that previously cost $100 now demands $120, while premium options that once cost $250 require closer to $300.

Multiple economic factors have created perfect conditions for unprecedented tire costs. Raw material prices have skyrocketed, with rubber futures spiking nearly 50% from early 2021. Passenger and light truck tires contain approximately 19% natural rubber, making them particularly vulnerable to fluctuations in this commodity.

The ripple effects began in 2020 when COVID-19 swept through major rubber-producing countries like Thailand and Malaysia. These nations closed their borders, preventing migrant workers from reaching plantations and reducing production. This labor shortage represented just the first domino in a series of supply chain complications.

Petroleum-based components that constitute roughly half the weight of modern tires have also increased dramatically:

Synthetic rubber prices soared alongside oil prices, especially following Russia's invasion of Ukraine

Carbon black, essential for giving tires their strength and color, doubled in price over a two-year period

Russia was previously the second-largest exporter of carbon black, creating additional supply constraints

Shipping surcharges ballooned from $2,500 to as much as $16,000, forcing retailers to pass costs to consumers

The passenger tire market now represents a staggering $204.3 billion industry in 2025. Experts project it will reach $284.1 billion by 2035, growing at a compound annual rate of 3.4%. This trajectory reflects both the essential nature of tires and manufacturers' ability to sustain higher prices in the current economic climate.

Tire manufacturers have been announcing price increases of 5-10%, with some specialty sizes seeing hikes of up to 12%. As stated by Goodyear CEO Richard Kramer in early 2022, "If we could make more, we can actually even sell more in the environment that we're seeing", highlighting how demand has remained resilient despite rising costs.

Rising insurance premiums have created a double burden for vehicle owners contemplating tire purchases. As households allocate more funds toward insurance—which has risen by an astonishing 45.8% since December 2021—less remains available for essential maintenance like tire replacement.

Many consumers are making difficult choices. Some are delaying tire purchases entirely, while others opt for budget alternatives that may compromise performance or longevity. Individuals have even resorted to extraordinary measures to afford tires, with reports of people selling personal possessions or creating GoFundMe campaigns simply to purchase new tires.

Rural households have been particularly hard hit. A study by Iowa State University found that while urban households saw their discretionary income fall by 13% between June 2020 and June 2022, rural families experienced a devastating 49% reduction. Without this financial cushion, rural drivers face "greater risk for increased debt, default, and potential bankruptcy" when confronted with necessary tire expenses.

The tire market itself continues to evolve. The 16 to 18-inch rim size segment currently holds 55.2% of market revenue, while SUV-specific tires contribute 53.8% of total sales. All-season tires remain dominant with 57.5% market share, reflecting consumers' preference for versatility amid budget constraints.

Find the best prices on all brand name tires from Performance Plus Tire to help handle these challenging economic conditions without compromising safety.

When insurance consumes a larger portion of the household budget, essential maintenance like tire replacement becomes a financial strain rather than a routine expense. This shift fundamentally alters how consumers approach tire purchases in 2025's economy.

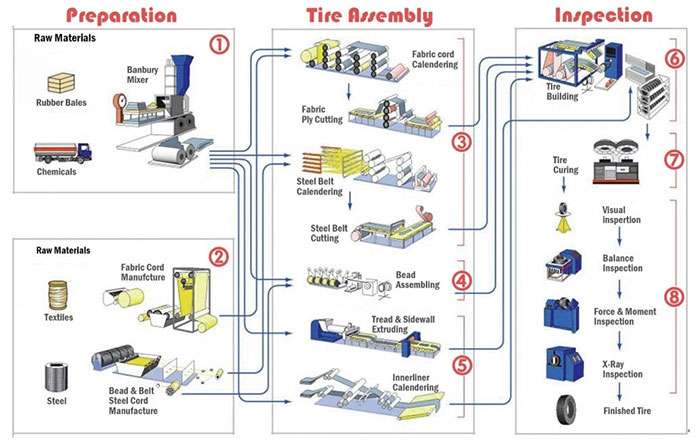

Image Source: ICONVEY

Raw materials form the foundation of tire manufacturing, with price volatility in these components driving much of the industry's current cost pressure. A complex web of supply chain challenges continues to reshape the tire industry landscape beyond the retail price increases consumers see at tire shops.

Southeast Asia dominates the global natural rubber market, controlling an astounding 90% of worldwide supply. Thailand, Malaysia, Indonesia, and Vietnam account for approximately 70% of production. This geographic concentration creates inherent supply vulnerabilities that directly impact tire costs.

Natural rubber prices surged nearly 20% in 2024 alone, following a dramatic 72% increase over just two quarters earlier in 2023. Several factors fuel this volatility. Rubber trees require 6-8 years to mature, creating significant production lags. Farmers increasingly abandon rubber cultivation for more profitable crops, exacerbating the supply-demand imbalance. Adverse weather conditions, including excessive monsoon rains and typhoons, have severely reduced output in major producing regions like Thailand and China, pushing prices to 13-year highs.

Synthetic rubber faces different challenges. Derived from petroleum, price fluctuations directly mirror oil market volatility. When petroleum prices rise, synthetic rubber production costs increase, creating a cascading effect throughout tire manufacturing. Approximately 24% of passenger tires and 11% of truck tires consist of synthetic polymers vulnerable to petroleum market swings.

Tires require substantial amounts of steel, carbon black, and other petroleum-derived components alongside rubber. Carbon black—essential for giving tires their strength, durability and color—doubled in price over a two-year period. This material plays a crucial role in increasing tire resistance to abrasion.

Steel, used primarily for tire reinforcement, faces its own supply challenges. Trade restrictions coupled with increased demand from other industries have created supply constraints and driven price increases for steel cords and belts. These materials help distribute vehicle weight evenly and strengthen tire structure.

These raw materials constitute approximately 60% of total tire production expenses. Natural and synthetic rubber plus carbon black make up roughly half of a car tire's composition. When one component faces supply issues, the entire production process feels the impact.

Getting raw materials to factories and finished tires to consumers presents the final piece of the tire cost puzzle. Freight rates have skyrocketed up to 500% in recent years. Vessels rerouted through the Cape of Good Hope face delays of 15-28 days. Transit times from India to the East Coast have stretched from 28 to 43 days.

Port congestion remains a persistent challenge. Major shipping hubs experience significant delays that increase lead times for tire shipments. Even pre-booked cargo shipments now experience approximately one month of delays. This disruption forces distributors to order products 45 days earlier than normal projections to maintain adequate inventory.

Truck driver shortages have slowed domestic distribution, affecting tire availability in stores. The global container shortage has resulted in spot freight rates soaring around 105%, creating yet another cost layer that manufacturers must pass along to consumers.

The combination of raw material volatility and logistics challenges creates a perfect storm for tire pricing—one that ultimately reaches consumers already feeling the pressure from rising insurance costs and overall inflation.

The astronomical rise in car insurance premiums has become a major factor in how drivers approach tire purchases. Auto insurance rates skyrocketed by 20.3% in 2023 alone, marking the fastest annual increase since the 1970s. This unprecedented surge is reshaping consumer priorities and forcing difficult decisions about vehicle maintenance.

Inflation has a direct impact on car insurance rates. Car insurance costs continue rising by double digits, with rates 19.5% higher in June 2024 than a year earlier. This dramatic increase reflects a complex web of factors beyond typical inflation measures.

Insurers point to several inflation-driven causes for these premium hikes:

Higher costs of automobiles, parts, and repairs

Increased accidents due to poor driving habits that emerged during the pandemic

Greater losses from severe weather events

The average annual premium for a driver with pristine driving history now exceeds $2,300, consuming a significant portion of household transportation budgets. This financial burden comes precisely when drivers also face rising costs for other vehicle necessities.

Nearly 40% of households now report difficulty affording non-discretionary transportation expenses, including insurance, fuel, and maintenance. This financial squeeze leaves less room in budgets for essential maintenance like tire replacement.

Insurance claims a larger share of transportation budgets, forcing consumers to make tough choices about what maintenance they can afford. The financial mathematics are straightforward—every additional dollar spent on insurance premiums represents one less dollar available for tires and other maintenance.

The rising cost of car insurance has become a serious economic burden reshaping consumer behavior. A 2023 TransUnion auto survey revealed that 24% of potential car buyers delayed or abandoned their vehicle purchases entirely due to high insurance costs. This hesitation extends to maintenance decisions as well.

Insurance premiums have become a pivotal factor in consumer decision-making journeys. When forced to choose between paying mandatory insurance premiums and discretionary maintenance expenses, consumers typically prioritize the former, often postponing tire replacement beyond recommended intervals.

Repair expenses increase insurance companies' claims payouts, leading to additional premium rate adjustments. This creates a cyclical pattern where rising repair costs drive insurance increases, which then reduce maintenance budgets, potentially leading to more repairs.

The practical consequences of this financial squeeze are evident in changing consumer tire-buying behaviors. Nearly 50% of drivers admit they have driven on tires longer than they would have in the past specifically to stretch out tire life and save money.

Approximately one-third of consumers report trying to save money by replacing only one or two tires instead of the recommended full set of four. This piecemeal approach to tire replacement often compromises vehicle handling and safety but represents the financial reality many drivers face.

"Now more than ever, consumers are feeling squeezed by everyday necessities like groceries and the growing basic costs of owning an automobile," notes Nathan Shipley, automotive industry analyst for Circana. This economic pressure leads to consumer cost-cutting behaviors that directly impact tire purchasing decisions.

The sustained increase in insurance premiums is creating ripple effects throughout vehicle maintenance patterns. Car insurance rates continue their upward trajectory—reaching historic highs in 2024-25—making tire replacement increasingly a financial decision rather than a safety-based one for many American households.

Image Source: Consumer Reports

American drivers are changing their tire buying habits dramatically. Inflation rates and insurance premiums claiming larger portions of household budgets force consumers to develop new strategies for managing essential vehicle maintenance costs.

Many drivers now postpone tire replacements well beyond recommended intervals. Economic strain leads consumers to use their current tires longer than they typically would before replacing them. This represents a calculated risk many feel forced to take.

Drivers push their tires to the absolute legal limit of 2/32" tread depth. At this critical point, tires become dangerously slippery, especially in wet conditions. Tire shoppers increasingly delay purchases, with many waiting until their tires are completely worn out.

The reality emerges in troubling statistics. Approximately 50% of drivers admit they've driven on tires longer than they would have in the past specifically to stretch tire life and save money. This behavior shows how deeply economic pressures are reshaping consumer priorities.

Consumers gravitate toward more affordable tire options. People who previously bought midrange brands now select budget tires. Those who might have replaced all four tires simultaneously attempt to manage with just two replacements.

The market for used tires has expanded substantially as consumers seek cost-cutting alternatives without completely compromising safety. Used tires typically lack warranties and may have uncertain histories, but many drivers see them as a necessary compromise in today's economy. Some tire store managers report significantly more customers buying used tires specifically to save money amid rising prices.

Economic pressures have eroded brand loyalty across the tire market. Even consumers who historically prioritized established tire brands for perceived quality and safety now consider less expensive alternatives. Find the best prices on all brand name tires from Performance Plus Tire if you're looking for quality options at reasonable prices without sacrificing safety.

Drivers are becoming increasingly invested in extending their current tires' lifespan. There's a noticeable upward trend in tire maintenance to maximize investments. Consumers adopt practices like regular tire rotation, ensuring proper inflation, and scheduling alignment checks.

Repair services that were once considered temporary fixes are gaining popularity as long-term solutions. Services such as patching and plugging now represent cost-effective alternatives to full replacement for many budget-conscious drivers.

Research from Consumer Reports reveals concerning gaps in maintenance practices. A disappointing 9% of respondents reported they never rotate their tires. This neglect ultimately costs more in the long run. Proper maintenance extends tire life substantially—correctly inflated tires can last approximately 4,700 miles longer.

Among Consumer Reports survey respondents, performance factors like handling (73%), wet grip (73%), and treadwear (66%) still outrank price (38%) as primary considerations. This suggests that even as budgets tighten, most drivers remain unwilling to completely compromise on quality and safety.

Tire retailers and manufacturers are adapting their business strategies to help consumers handle rising costs while maintaining sales volumes despite inflation and rising insurance expenses.

Tire dealers now use dynamic pricing—adjusting prices in real-time based on demand, supply, weather, competition, and customer behavior. This approach, common in retail, hospitality, and transportation, helps optimize revenue by charging the highest price customers will pay while staying competitive. Retailers might charge higher rates for walk-ins who need immediate service while offering lower prices for customers who schedule appointments ahead of time.

"Surgical discounting" has emerged as a targeted approach to drive demand without hurting margins. Successful strategies include seasonal discounts during specific weather conditions, special promotions, loyalty programs, and referral discounts. Tire pricing software makes implementing and managing these promotions much simpler.

Major tire retailers have expanded payment options to help consumers manage larger purchases. Goodyear offers up to 6-month financing on purchases of $250 or more with their credit card. Discount Tire provides promotional financing for 6, 9, or 12 months on qualifying purchases. Firestone extends 6-month deferred interest on purchases over $149.

Alternative payment methods are gaining popularity. Options like "Buy Now, Pay Later" through services such as Affirm and Zip allow customers to split purchases into manageable payments. These flexible payment solutions help customers maintain vehicle safety despite financial constraints.

With inflation continuing above the Federal Reserve's target rate, tire manufacturers are adjusting their product ranges. There's growing emphasis on value-tier products that offer reasonable quality at lower price points. This trend responds directly to how inflation and insurance trends affect consumer purchasing power.

While tier-one tires remained popular earlier in the inflationary cycle, tier-three brands are gaining traction as more consumers feel the economic squeeze. Find the best prices on all brand name tires from Performance Plus Tire across various tiers to meet different budget needs.

Image Source: smarttirecompany.com

Innovation continues driving the tire industry forward, yet these advancements bring price implications that drivers cannot ignore amid today's economic challenges.

Smart tires represent the cutting edge of automotive safety technology today. These advanced products feature embedded sensors that monitor tire pressure, temperature, tread wear, and road conditions in real-time. Unlike traditional monitoring systems that require costly hardware installations, newer software-based solutions analyze vehicle data to detect issues without additional components.

The technology delivers substantial benefits—early warnings for loose wheels, grip estimation for hazardous conditions, and predictive maintenance capabilities. However, these innovations typically increase production costs through additional sensors, microchips, and connectivity features.

Sustainability has become a core focus alongside smart technology. Major manufacturers have made impressive progress—Bridgestone now produces tires with 75% recycled materials, while Continental's UltraContact NXT incorporates up to 65% sustainable content.

These eco-friendly options provide tangible benefits beyond environmental advantages. Low-rolling resistance designs can improve fuel economy by 3-7%, potentially saving 18-42 gallons annually for vehicles averaging 25 MPG. Developing sustainable materials requires substantial research investment, increasing production costs.

Technologically advanced tires present a complex value proposition compared to conventional options. Run-flat technology enables continued driving despite punctures. Low rolling resistance designs reduce energy consumption. Both improvements enhance safety and efficiency while increasing manufacturing complexity.

When inflation and insurance trends already strain household budgets, manufacturers must carefully balance innovation with accessibility. The challenge remains offering sufficient technological advancement while keeping prices attainable for consumers increasingly forced to prioritize immediate costs over long-term performance benefits.

Looking ahead, several key trends will shape how inflation and insurance costs affect tire purchases in the coming years.

After years of dramatic premium increases, drivers may finally see some relief on the horizon. Auto insurers are projected to raise rates by an average of 7.5% in 2025—a significant slowdown from the 16.5% increase in 2024 and 12% in 2023. The average cost of full coverage car insurance will still reach a record high of $2,101 per year.

Rate adjustments already began moderating throughout 2024, slowing to 10% year-over-year compared to 15% in 2023. This improvement reflects better insurer profitability, with direct written premiums growing 13.6% to $359 billion.

For tire buyers, this moderation means household budgets may face less pressure from insurance costs, potentially freeing up funds for essential maintenance like tire replacement.

Interest rates directly impact your spending power for tire purchases. Higher rates make variable-rate debt more expensive to service, typically reducing discretionary spending. These economic forces affect the entire tire industry, from manufacturing costs to consumer credit availability.

When interest rates climb, financing options for tire purchases become more expensive. This creates additional pressure on consumers already dealing with higher tire prices and insurance premiums.

New environmental regulations will likely increase tire production costs as manufacturers invest in cleaner production methods and sustainable materials. This shift toward environmentally friendly processes has already raised manufacturing expenses.

Sustainability practices are becoming increasingly important to consumers, potentially influencing purchasing decisions as much as price and performance. We expect to see more eco-friendly tire options, though they may come at a premium initially.

The tire industry continues adapting to these economic pressures. Manufacturers and retailers are finding new ways to help consumers manage costs while maintaining safety standards. Understanding these trends helps you make better decisions about when and how to purchase your next set of tires.

The perfect storm of inflation and insurance premium increases has changed how drivers approach tire purchases today. Tire prices have jumped to $223 per tire—well above the $167 average from five years ago. Auto insurance premiums have surged by 19.5%, creating serious pressure on household transportation budgets.

Drivers now face tough choices when their tires need replacement. Half of all consumers admit they drive on worn tires longer than they previously would, while others switch to budget brands or used tires despite potential safety compromises. This shift toward cost-cutting measures reflects the economic reality where insurance claims a larger portion of household budgets.

Raw material volatility plays a major role in today's tire pricing. Natural rubber price spikes, petroleum-based component increases, and global shipping disruptions have created multiple layers of cost pressure that manufacturers pass along to consumers. These supply chain challenges show few signs of improvement.

The bright spot amid these challenges appears in how tire retailers and manufacturers have adapted their strategies. Flexible payment plans, dynamic pricing models, and expanded mid-range tire options help consumers handle these economic pressures. Tire maintenance services have gained popularity as drivers seek to extend their current tires' lifespan rather than replace them.

Some relief may be coming. Auto insurance rate increases are projected to moderate to 7.5% in 2025—still an increase, but significantly lower than previous years. This trend offers hope, though drivers will continue feeling the squeeze of inflation on their tire-buying decisions.

Understanding these economic forces helps drivers make better choices about tire purchases. Whether through improved maintenance practices, exploring payment options, or researching cost-effective alternatives, consumers can handle today's challenging market conditions while still prioritizing vehicle safety. The relationship between inflation and insurance costs will continue shaping tire purchasing patterns for years to come.

Understanding how inflation and insurance costs reshape tire purchasing decisions helps drivers make smarter financial choices while maintaining vehicle safety.

• Tire prices have surged 34% since 2020 - Average cost jumped from $167 to $223 per tire due to raw material volatility and supply chain disruptions

• Auto insurance premiums rose 19.5% in 2024 - This unprecedented increase forces drivers to delay tire purchases or choose budget alternatives over safety

• 50% of drivers now postpone tire replacement - Economic pressure leads consumers to drive on worn tires longer than recommended, compromising safety

• Payment plans and financing options expand - Major retailers offer 6-12 month financing to help consumers manage tire purchases despite budget constraints

• Relief may come in 2025 - Insurance rate increases are projected to slow to 7.5%, potentially easing pressure on household transportation budgets

The economic reality is clear: when insurance consumes more of your budget, tire maintenance becomes a financial decision rather than a safety priority. Smart consumers can navigate these challenges by exploring financing options, maintaining current tires properly, and shopping strategically for the best value without compromising essential safety features.

When buying tires, consider the type (all-season, winter, etc.), your driving conditions and style, budget, speed rating, and proper tire size for your vehicle. Balancing performance, safety, and cost is crucial in today's economic climate.

Inflation affects car insurance rates by increasing repair costs, vehicle prices, and medical expenses. This leads insurers to raise premiums to cover higher claim payouts, resulting in a significant increase in auto insurance costs for consumers.

Drivers should check their tire pressure at least once a month and before long trips. Regular checks help maintain proper inflation, which improves fuel efficiency, extends tire life, and ensures optimal vehicle safety and performance.

The recommended tire inflation pressure varies by vehicle and tire type. Generally, it ranges between 30-35 PSI for passenger cars. Always refer to your vehicle's owner manual or the placard inside the driver's side door jamb for the correct pressure.

Consumers are adapting by delaying tire replacements, opting for budget or used tires, and showing increased interest in tire maintenance and repair. Many are also utilizing financing options and seeking value-tier products to manage costs while maintaining vehicle safety.